Categories: ABA Validation

Bank Account Validation: Top 5 Easy Ways to Verify in 2024

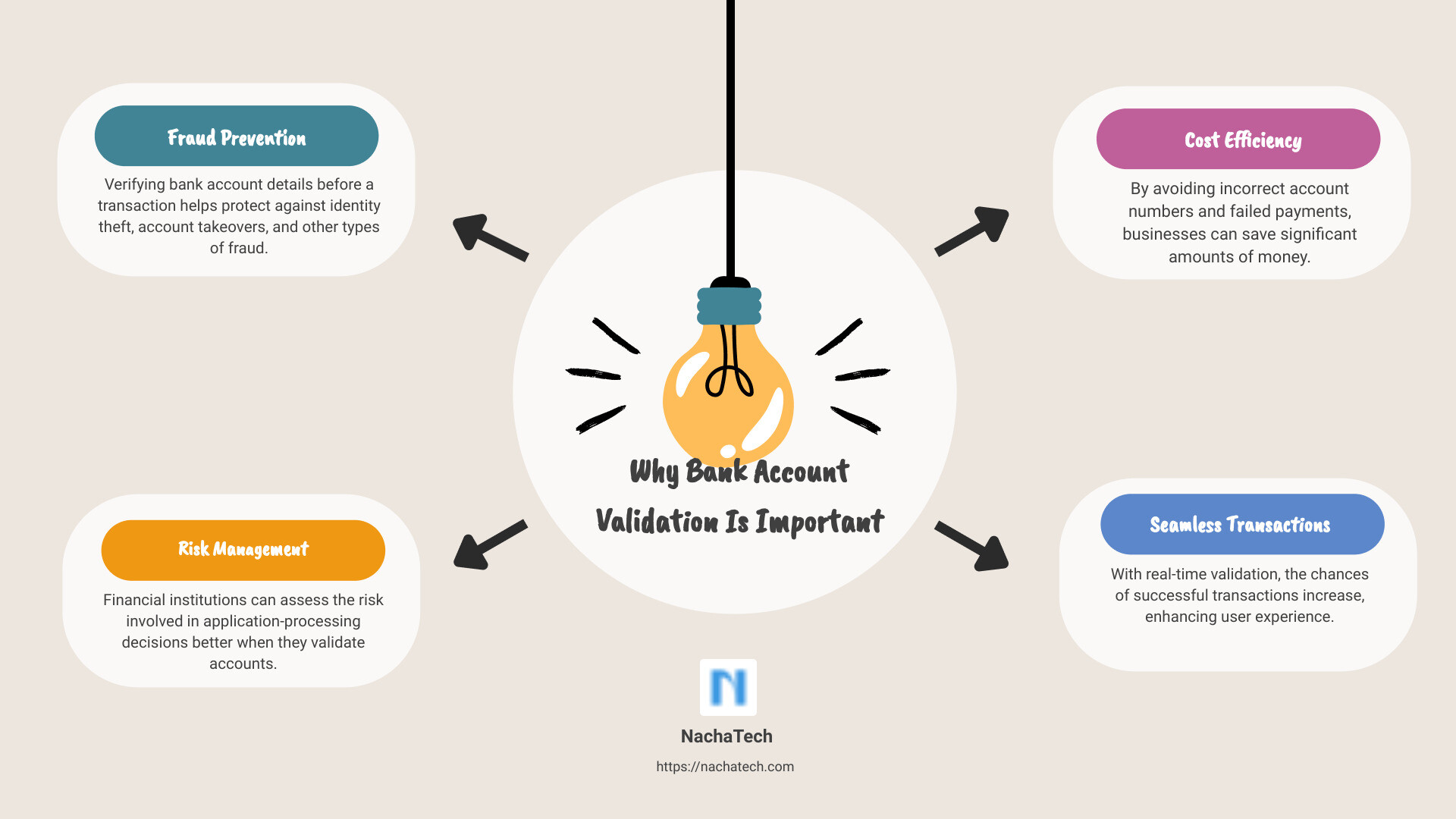

Why Bank Account Validation Is Important

Bank account validation is crucial for anyone involved in financial transactions, from businesses to individual users.

If you want a quick explanation: Account validation ensures the bank account details are correct before processing any transactions. This prevents fraud, minimizes risks, and reduces costs associated with failed payments.

Let’s break down why this matters:

- Fraud Prevention: Verifying bank account details before a transaction helps protect against identity theft, account takeovers, and other types of fraud.

- Risk Management: Financial institutions can assess the risk involved in application-processing decisions better when they validate accounts.

- Cost Efficiency: By avoiding incorrect account numbers and failed payments, businesses can save significant amounts of money.

- Seamless Transactions: With real-time validation, the chances of successful transactions increase, enhancing user experience.

Taking extra steps to validate bank account details may seem tedious, but it plays a vital role in ensuring that financial transactions are smooth, safe, and reliable.

What is Bank Account Validation?

Bank account validation is the process of confirming that a bank account’s details are correct and active before processing a transaction. This ensures that the account number, routing number, and other critical details are accurate. By verifying these details, businesses and financial institutions can minimize the risk of fraud, failed payments, and other transaction issues.

The Validation Process

The validation process can vary depending on the method used. Here are the key steps:

- Collect Account Details: Gather essential information such as the account number, routing number, and account holder’s name.

- Verification: Use manual or automated methods to check the accuracy of these details.

- Confirmation: Confirm that the account is active and capable of receiving transactions.

Instant Bank Verification

One of the most efficient methods is Instant Bank Verification. This method uses technology to validate account details in real-time, providing immediate feedback. It checks the bank details, account number, routing number, balance, and account holder’s name within seconds.

Key Benefits:

- Speed: Immediate validation reduces waiting times.

- Accuracy: Real-time checks ensure the information is up-to-date.

- User Experience: A seamless process enhances user satisfaction and reduces drop-offs.

Account Details

When validating a bank account, several details are checked:

- Account Number: The unique identifier for the bank account.

- Routing Number: A nine-digit code that identifies the financial institution.

- Account Holder’s Name: The name associated with the bank account.

- Balance (Optional): Some validation processes also check the account balance to ensure sufficient funds for the transaction.

Transaction Processing

By validating bank account details before processing transactions, businesses can avoid common pitfalls such as:

- Failed Payments: Incorrect account information can lead to payment rejections.

- Fraud: Verifying details helps prevent fraudulent transactions and identity theft.

- Operational Delays: Faster validation means transactions can be processed more quickly, improving cash flow and customer satisfaction.

Bank account validation is a crucial step in ensuring secure and efficient financial transactions. By understanding and implementing this process, businesses can significantly reduce risks and enhance their overall transaction experience.

Methods to Validate Bank Account Details

Manual Verification

Manual verification involves confirming bank account details by directly contacting the customer’s bank. This method can be time-consuming but is straightforward.

- Customer Information: Collect the customer’s bank account number and routing number.

- Call the Bank: Contact the bank to verify the account details. This can confirm whether the account is active and whether the customer is the account holder.

While manual verification is reliable, it can be slow and may not be scalable for businesses processing a high volume of transactions.

Automated Services

Automated services provide instant validation of bank account details, offering a seamless user experience and reducing drop-offs.

- Instant Validation: These services can confirm bank details, including account number, routing number, and account holder’s name, within seconds.

- API Integration: Easily integrate these services into your existing systems using a plug-and-play API. This allows for seamless onboarding and payment setup.

- Seamless User Experience: Automated validation ensures a smooth transaction flow, reducing the chances of user abandonment.

Automated services are ideal for businesses looking to scale and need quick, reliable validation.

ACH Prenotification

ACH prenotification is a method used within the ACH network to validate first-use consumer account information, ensuring Nacha rule compliance.

- First-Use Consumer Account Information: When setting up a new payment, an ACH prenotification entry is sent to the bank to verify the account details.

- Nacha Rule Compliance: This method meets Nacha’s requirements for validating consumer account numbers for web debit entries.

ACH prenotification is a reliable way to ensure account details are correct before initiating transactions, helping to prevent payment rejections and fraud.

Micro-Transaction Verification

Micro-transaction verification involves making small deposits into the customer’s bank account to confirm ownership.

- Small Deposits: The business makes one or two small deposits into the customer’s account.

- Account Confirmation: The customer then verifies the amounts of these deposits to confirm they have access to the account.

- User Verification: This method ensures that the account is valid and that the customer has control over it.

Micro-transaction verification is a robust and user-friendly method to validate bank account details, making it a popular choice for many businesses.

By utilizing these methods, businesses can ensure accurate and secure bank account validation, reducing the risk of fraud and improving transaction efficiency.

Benefits of Bank Account Validation

Fraud Prevention

Bank account validation is a powerful tool in the fight against fraud. By verifying account details, businesses can prevent identity theft, account takeovers, and the creation of fake accounts. For instance, a financial institution that incorporated ValidiFI’s Bank Account Validation solution saw a significant reduction in fraudulent activities. This real-time validation ensures that the routing number and account number match, making it harder for fraudsters to use stolen or fake bank details.

Risk Management

Evaluating risk is crucial for any financial transaction. With bank account validation, businesses can make informed application-processing decisions and minimize fraud loss. By assessing the account longevity, payment performance, and account stability, organizations can better understand the risk associated with a particular account. This not only helps in reducing potential fraud but also aids in making smarter underwriting decisions.

Cost Efficiency

One of the major benefits of bank account validation is cost efficiency. Failed payments due to incorrect or invalid account details can be costly. By validating account details in real-time, businesses can reduce costs associated with failed transactions and avoid the hassle of dealing with bad account numbers. For example, using tools like ACH Genie’s ACH validation software can help businesses avoid financial losses due to incorrect ABA numbers, ensuring that every transaction is accurate and valid.

Seamless Transactions

Bank account validation ensures seamless transactions by providing real-time validation of account details. This leads to a successful transaction flow and enhances the user experience. For instance, a financial institution that used ValidiFI’s API integration during the application process was able to reduce manual verification steps and improve their payment processing KPIs. This not only saves time but also builds trust with customers by ensuring their transactions are processed smoothly and accurately.

By leveraging bank account validation, businesses can protect themselves from fraud, manage risks effectively, reduce operational costs, and ensure a seamless transaction experience for their users.

Global Coverage and Compliance

When it comes to bank account validation, having global coverage and compliance with local regulations is crucial. Here’s a breakdown of how validation works across different countries and the specific requirements for each:

US

In the United States, the focus is on ACH payments. To validate a bank account, you need the routing number, account number, and the holder name. The routing number is a nine-digit code that identifies financial institutions. This is essential for ensuring that the transaction is directed to the correct bank.

Compliance with Nacha rules is mandatory. Nacha, which governs the ACH network, requires originators of WEB debit entries to use a “commercially reasonable fraudulent transaction detection system” to detect fraud in web debit transactions. This rule took effect on March 19, 2021, and has been a game-changer for reducing fraud in the ACH network.

Canada

In Canada, the process involves EFT payments. For validation, you need the transit number, account number, and the holder name. The transit number is an eight-digit code consisting of a three-digit FIN code and a five-digit branch number. This ensures that funds are directed to the correct branch of the financial institution.

UK

In the UK, faster payments are the norm. To validate an account, you’ll need the sort code, account number, and the holder name. The sort code is a six-digit number that identifies the bank and branch where the account is held. This allows for quick and efficient payments.

Australia

For Australia, validation requires the BSB numbers, account number, and the holder name. The BSB number is a six-digit code that identifies the bank and branch. This system facilitates faster payments and ensures that funds are directed accurately.

India

In India, the process involves the IFSC code, account number, and the holder name. The IFSC code is an eleven-character code that identifies the bank and branch. This is crucial for routing payments correctly within the country’s banking system.

By ensuring compliance with local regulations and utilizing the correct validation methods, businesses can minimize fraud, manage risks, and ensure seamless transactions across different countries. This global approach to bank account validation is vital for any business looking to operate internationally.

Frequently Asked Questions about Bank Account Validation

What is bank account validation?

Bank account validation is the process of verifying that a bank account number and its associated details are correct and active. This can involve checking the bank’s name, the account holder’s name, the routing number, and the account number itself. Instant bank verification allows businesses to confirm these details quickly, ensuring that transactions can proceed smoothly and securely.

How to check if a bank account is valid?

To check if a bank account is valid, you can:

- Call the bank directly and provide the customer information, such as the routing and account numbers.

- Use automated services that offer instant validation through API integration, which can verify the account details in real-time.

- For ACH payments, you can perform an ACH prenotification to verify consumer account information before initiating the transaction.

What does it mean when bank account validation fails?

When bank account validation fails, it usually means that some information provided is incorrect or the account is in a disabled_irrecoverable state. This can lead to:

- Payment rejection: The transaction cannot be processed, causing delays and potential disruptions in cash flow.

- Incorrect information: The account number, routing number, or account holder’s name might be wrong.

- Disabled account: The account could be closed or not set up for the type of transaction being attempted.

Ensuring accurate and validated bank account details can prevent these issues and ensure seamless financial transactions.

Conclusion

At ACH Genie, we understand the critical role that bank account validation plays in today’s financial landscape. Our advanced financial technology solutions ensure that your ACH files are accurate and compliant, helping to prevent fraud and streamline transactions.

Fraud prevention is one of the most significant benefits of our services. By validating bank account details, we help you avoid identity theft, account takeovers, and the creation of fake accounts. This not only protects your business but also enhances the trust and security your customers feel.

ACH file validation is another key area where ACH Genie excels. Our tools ensure that your ACH transactions are error-free, reducing the risk of payment rejections and associated costs. This leads to seamless transactions, improving user experience and operational efficiency.

When digital transformation is rapidly changing how we handle financial transactions, having a reliable partner like ACH Genie can make all the difference. Our solutions are designed to provide you with the confidence and security you need to focus on growing your business.

For more information on how ACH Genie can help you with bank account validation and other financial technology solutions, visit our website.

By leveraging our expertise, you can ensure that your financial operations are not only efficient but also secure and compliant with the latest industry standards.