Categories: ACH Payments

ACH Addenda Type Code DTM: Top Benefits in 2024

Why Understanding ACH Addenda Type Code DTM is Crucial

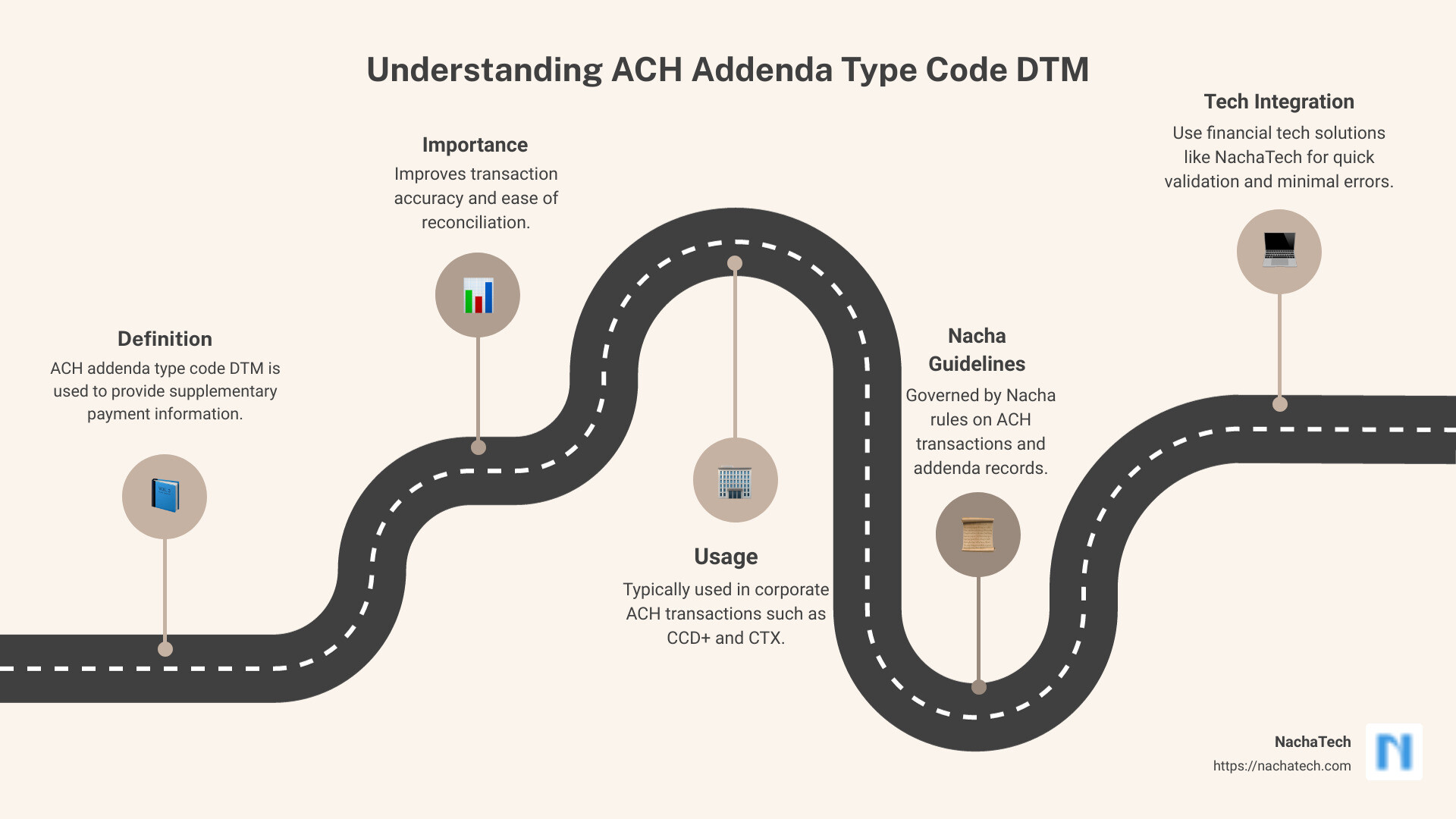

When it comes to managing ACH payments, staying organized is key. One powerful tool that can help you keep your transactions straight is the ACH addenda type code DTM. This code is especially relevant for financial institutions aiming to streamline their payment process and minimize errors.

Right off the bat, here’s what you need to know about ACH addenda type code DTM:

- What it is: A code used in ACH addenda records to provide supplementary payment information.

- Why it’s important: It helps identify the transaction details, improving accuracy and ease of reconciliation.

- Where to use it: Typically employed in corporate ACH transactions like CCD+ and CTX.

ACH payments (Automated Clearing House payments) are electronic transactions that allow businesses to move money directly between bank accounts using the ACH network. These payments are not only cost-effective but also reduce the risk of involuntary churn.

Addenda records are optional but highly beneficial records that accompany ACH transactions. They hold extra information that aids in transaction identification and simplifies record-keeping.

Here’s an example: If you’re managing hundreds of payments each month, using addenda records to include supplementary details can massively simplify your workload. Not only does it make for easier tracking, but it also helps in better communication between involved financial institutions.

Understanding the role of Nacha (National Automated Clearing House Association) is essential because their rules govern how ACH transactions should be conducted, including the proper use of addenda records and type codes like DTM.

By integrating financial technology like ACH Genie’s software solutions, you can open, edit, and validate ACH files quickly, drastically reducing errors and rejections.

Understanding ACH Payments

ACH payments, also known as ACH transfers or transactions, are electronic bank-to-bank payments used by businesses across the United States. These payments utilize the ACH network instead of card networks like Visa or American Express.

Types of ACH Payments

There are two primary categories of ACH payments:

-

Direct Deposits: These are electronic deposits made directly into a recipient’s bank account. Common examples include payroll, tax refunds, and government benefits.

-

Direct Payments: These are electronic payments made from one bank account to another. Examples include bill payments, vendor payments, and donations.

Benefits of ACH Payments

Low Fees: ACH payments generally come with lower fees compared to other payment methods like credit cards. This makes them a cost-effective option for businesses.

Reduced Risk: ACH payments offer a reduced risk of involuntary churn. Since they are directly linked to bank accounts, they are less likely to be declined or canceled compared to credit card payments.

Reliability: ACH payments are reliable and secure, thanks to the robust framework and regulations set by Nacha, the National Automated Clearing House Association.

Processing Time: Although ACH payments typically take around three working days to process, the introduction of Same Day ACH has made it possible to expedite certain transactions, improving cash flow and operational efficiency.

How ACH Payments Work

-

Initiation: The payer initiates an ACH payment through their bank or a payment processor.

-

Batching: The payment is then grouped into a batch with other ACH payments.

-

Transmission: The batch is transmitted to an ACH operator, which could be the Federal Reserve or a private operator.

-

Processing: The ACH operator processes the batch and sends the payment details to the receiving bank.

-

Settlement: The receiving bank credits the recipient’s account, completing the transaction.

By understanding how ACH payments function and their benefits, businesses can make informed decisions on using this efficient and cost-effective payment method.

Next, we’ll delve into ACH Addenda Type Code DTM and its importance in providing additional transaction information.

What is an ACH Addenda Record?

An ACH addenda record is like a note attached to your ACH payment. It provides extra information about the transaction. This supplemental data helps identify the account holder or gives specific payment details to the receiver.

Why Are Addenda Records Important?

Addenda records are crucial because they carry payment information that the receiving bank (RDFI) needs. This information can include things like invoice numbers, transaction descriptions, or other relevant details.

How Does It Work?

When you send an ACH payment, you can include an addenda record. This record travels with the payment through the ACH network and reaches the RDFI. The RDFI then uses this information to process the payment accurately.

Real-World Example

Imagine you’re a business paying a supplier. You make an ACH payment and include an addenda record with the invoice number. The supplier’s bank receives this payment along with the invoice number, making it easy for them to match the payment to the correct invoice.

Key Elements of an Addenda Record

- Addenda Type Code: Identifies the type of information in the addenda record.

- Payment-Related Information: Up to 80 characters of free-form text.

- Addenda Sequence Number: Indicates the sequence of the addenda record.

- Entry Detail Sequence Number: Matches the addenda record to the related payment entry.

Benefits

- Improved Record-Keeping: Keeps all payment details organized.

- Easier Reconciliation: Helps accounting teams match payments to invoices.

- Better Communication: Provides both banks with necessary transaction details.

Next, we’ll delve into ACH Addenda Type Code DTM and its importance in providing additional transaction information.

ACH Addenda Type Code DTM

Understanding the ACH addenda type code DTM is essential for anyone dealing with ACH transactions. Let’s break it down.

What is ACH Addenda Type Code DTM?

The DTM code stands for “Date/Time Reference”. It is one of the many addenda type codes used in ACH transactions. This code is specifically used to provide date and time details related to the payment. Think of it as a timestamp that can help clarify when a transaction occurred.

How Does DTM Fit into Nacha Rules?

According to Nacha rules, addenda records like DTM are optional. This means you don’t have to include them in every transaction, but they can be very useful. For example, if you need to specify the exact date and time a payment was made, the DTM code is your go-to.

Why Use DTM?

Using the DTM code can bring several benefits:

- Clarity: It provides a clear timestamp for the transaction, which can help in auditing and reconciliation.

- Accuracy: Helps ensure that all parties involved have the exact date and time details.

- Compliance: Meets specific business or regulatory requirements that may demand date and time information.

Optional but Beneficial

While addenda records like DTM are optional, they can be very beneficial. Including them can simplify record-keeping and improve the accuracy of your financial data. It’s like adding extra notes to a diary entry—optional, but often very helpful.

Example of DTM in Action

Imagine a company that needs to track the exact time payments are received to manage cash flow better. By including a DTM addenda record in their ACH transactions, they can easily see when funds were transferred, helping them make more informed financial decisions.

Next, we’ll look at Common ACH Addenda Record Formats and how different formats can be used effectively.

Common ACH Addenda Record Formats

When dealing with ACH addenda records, the format you choose matters. Different formats serve different purposes and offer various levels of detail. Here, we’ll focus on two commonly used formats: CCD+ and CTX.

CCD+ Format

CCD+ stands for Corporate Credit or Debit with Addenda. This format is popular for business-to-business transactions. It allows one addenda record per transaction, which can include 80 characters of payment-related information.

Key Elements of CCD+ Format:

- Record Type Code: Always “7” for addenda records.

- Addenda Type Code: Always “05” for CCD+ transactions.

- Payment-Related Information: Up to 80 characters of alphanumeric text.

- Addenda Sequence Number: Numeric, usually “1” since only one addenda is allowed.

- Entry Detail Sequence Number: Numeric, matching the last seven digits of the trace number of the related entry.

CTX Format

CTX, or Corporate Trade Exchange, supports more complex transactions that often need multiple addenda records. This format is ideal for trading partner relationships. You can include up to 9,999 addenda records, each carrying detailed payment-related information.

Key Elements of CTX Format:

- Record Type Code: Always “7” for addenda records.

- Addenda Type Code: Always “05” for CTX transactions.

- Payment-Related Information: Up to 80 characters per addenda record.

- Addenda Sequence Number: Numeric, indicating the sequence of multiple addenda records.

- Entry Detail Sequence Number: Numeric, matching the last seven digits of the trace number of the related entry.

Comparing CCD+ and CTX

| Feature | CCD+ | CTX |

|---|---|---|

| Addenda Records Allowed | 1 | Up to 9,999 |

| Use Case | Simple B2B payments | Complex B2B transactions |

| Payment-Related Info | 80 characters | 80 characters per addenda |

| Addenda Type Code | 05 | 05 |

| Record Type Code | 7 | 7 |

Why Use Addenda Records?

Addenda records offer a way to include extra information about a transaction. Think of them as the “notes” section of a payment. This extra detail can simplify record-keeping and make reconciliation easier for your accounting team.

For example, a company paying multiple invoices with one ACH transaction can use addenda records to specify which invoices are being paid. This helps both the sender and receiver keep track of payments more efficiently.

Next, we’ll discuss the Benefits of Using ACH Addenda Records and how they can streamline your financial processes.

Benefits of Using ACH Addenda Records

ACH addenda records offer several key benefits that can streamline your financial processes. Let’s break them down:

Transaction Information

Addenda records provide detailed information about each transaction. Imagine you’re a business paying multiple invoices with a single ACH transaction. The addenda record can list each invoice number, making it easy for both you and the receiver to identify what was paid.

Memos

Think of addenda records as memos attached to your payments. These memos can include important notes or instructions that clarify the purpose of the transaction. For instance, if you’re paying for a service, the addenda can specify the service period, making it easier for the receiver to reconcile their records.

Record-Keeping

Using addenda records can simplify record-keeping. With all the extra details included in the transaction, you won’t need to dig through emails or paper invoices to find out what each payment was for. Everything is neatly packaged in the ACH addenda record.

Reconciliation

Addenda records make reconciliation a breeze. When your accounting team knows exactly what each payment covers, they can match transactions to invoices or other records quickly. This reduces errors and speeds up the reconciliation process.

Communication

Finally, addenda records improve communication between financial institutions. Both the sending and receiving banks can see the extra details, which helps prevent misunderstandings and errors. This leads to smoother transactions and better relationships with your financial partners.

In summary, using ACH addenda records can save you time, reduce errors, and improve communication. Next, we’ll dive into How to Implement ACH Addenda Type Code DTM and ensure your transactions are as efficient as possible.

How to Implement ACH Addenda Type Code DTM

Implementing ACH addenda type code DTM can seem daunting, but with a step-by-step approach, it becomes manageable. Let’s break it down.

Step-by-Step Guide

-

Understand the Purpose: The DTM (Date/Time Reference) code in an ACH addenda record provides specific date and time information about the transaction. This can be crucial for tracking and reconciling payments.

-

Gather Necessary Information: Before you start, ensure you have all the required details, such as transaction dates, times, and any other relevant data.

-

Format the Addenda Record: According to Nacha rules, the addenda record should follow a specific format. Here’s a simplified version:

-

Record Type Code: Always “7” for addenda records.

- Addenda Type Code: For DTM, this should be “05”.

- Payment-Related Information: This is where you include the date and time details.

- Addenda Sequence Number: Indicates the position of the addenda record within the batch.

- Entry Detail Sequence Number: Matches the sequence number of the original entry detail record.

Example Format:

| Field Name | Position | Length | Data Type | Example |

|---|---|---|---|---|

| Record Type Code | 01-01 | 1 | Numeric | 7 |

| Addenda Type Code | 02-03 | 2 | Numeric | 05 |

| Payment-Related Information | 04-83 | 80 | Alphanumeric | 20230315T1030 |

| Addenda Sequence Number | 84-87 | 4 | Numeric | 0001 |

| Entry Detail Sequence Number | 88-94 | 7 | Numeric | 0000001 |

-

Validate the Record: Before submitting, validate the addenda record to ensure it meets Nacha standards. This includes checking the format and ensuring all required fields are filled correctly.

-

Transmit the File: Once validated, include the addenda record in your ACH file and transmit it to your financial institution.

Formatting Tips

- Use Proper Codes: Ensure you use the correct codes for each field. For DTM, the addenda type code should always be “05”.

- Keep It Simple: Stick to the required 80 characters for payment-related information. Avoid unnecessary details.

- Double-Check Dates and Times: Make sure the date and time are in the correct format (YYYYMMDDTHHMM).

Validation

ACH Genie offers tools to help validate your ACH files. Using these tools can save time and reduce errors. They check for common issues like incorrect formats or missing fields.

ACH Genie Validation Tool:

- Automated Checks: The tool automatically reviews your ACH file for compliance with Nacha rules.

- Error Reports: If there are errors, you’ll get a detailed report showing what needs to be fixed.

- Easy Corrections: The tool provides guidance on how to correct any issues.

By following these steps and using ACH Genie’s validation tools, you can ensure your ACH addenda type code DTM is implemented correctly, reducing errors and improving transaction efficiency.

Next up, we’ll explore Frequently Asked Questions about ACH Addenda Type Code DTM to address any lingering doubts you might have.

Frequently Asked Questions about ACH Addenda Type Code DTM

What is the purpose of an ACH addenda record?

An ACH addenda record serves as a memo or note attached to an ACH payment. It provides extra information needed to identify the account holder or to give payment details to the receiver. Think of it as the “fine print” that helps clarify the transaction.

How do I format an ACH addenda record?

Formatting an ACH addenda record depends on the type of ACH transaction you’re using, like CCD+ or CTX. Here’s a quick breakdown of the CCD+ ACH addenda record format:

| Field | Name | Required | Value Type | Length | Position |

|---|---|---|---|---|---|

| 1 | Record Type Code | Yes | “07” | 1 | 01-01 |

| 2 | Addenda Type Code | Yes | “05” | 2 | 02-03 |

| 3 | Payment Related Information | Yes | Alphanumeric | 80 | 04-83 |

| 4 | Addenda Sequence Number | Yes | Numeric | 4 | 84-87 |

| 5 | Entry Detail Sequence Number | Yes | Numeric | 7 | 88-94 |

You have 80 characters to provide payment-related information. This format is crucial for compliance with Nacha rules.

What are the benefits of using ACH addenda records?

ACH addenda records offer several benefits:

- Detailed Transaction Information: They provide extra details about each payment, making it easier to track and manage transactions.

- Simplified Record-Keeping: Helps your accounting team by making the reconciliation process easier and more accurate.

- Enhanced Communication: Improves communication between financial institutions, ensuring all necessary information is shared and understood.

Using ACH addenda records can streamline your financial operations and reduce errors.

Conclusion

ACH Genie makes managing ACH payments simpler and more efficient. One of the main challenges businesses face with ACH payments is ACH payment rejections. These rejections can disrupt cash flow and cause administrative headaches.

ACH Genie offers tools that help you avoid these issues. Our software supports raw line editing and fast validation of ACH files. This ensures your ACH transactions are accurate and compliant with Nacha rules.

By using ACH Genie, you can streamline your payment processes, reduce errors, and avoid costly rejections. This allows your business to focus on what it does best, without worrying about payment issues.

Ready to streamline your ACH payments? Learn more about how ACH Genie can help you.