Categories: ACH Payments

What is an ACH Addenda Notice? 7 Key Facts Unveiled

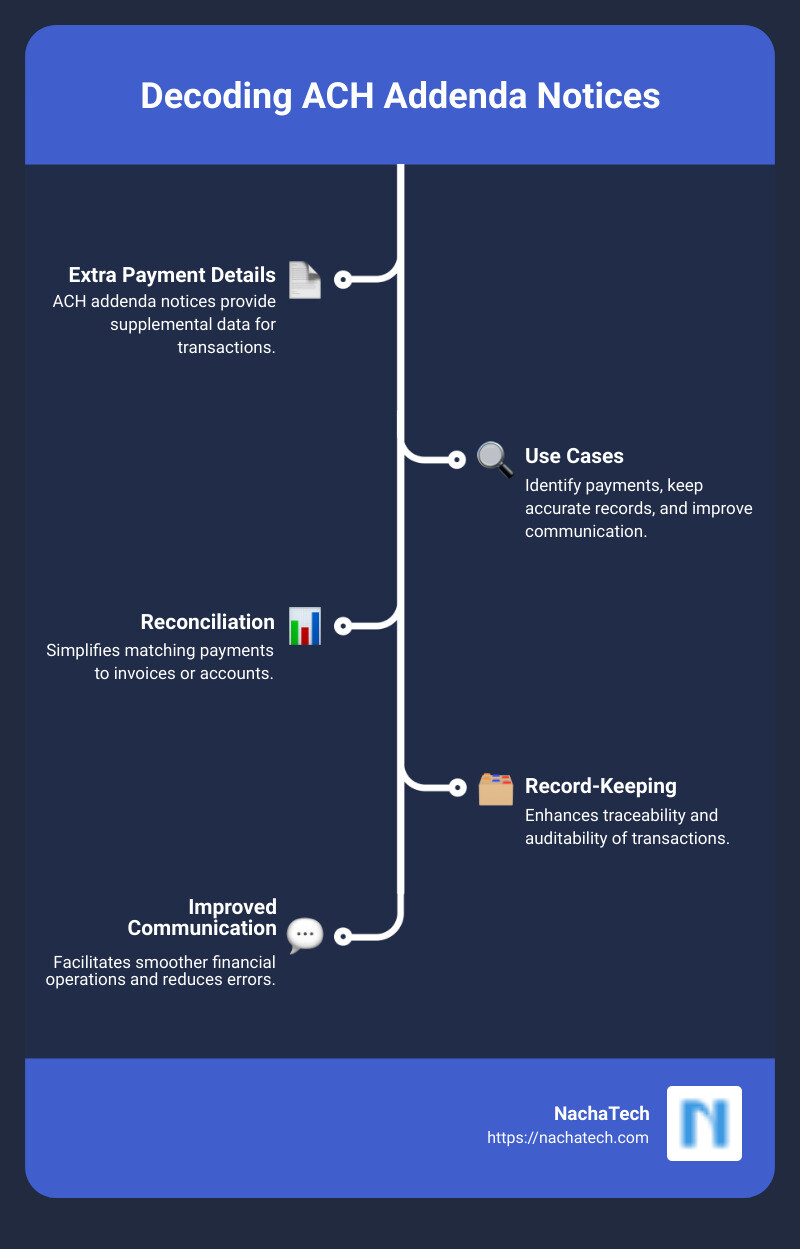

Decoding ACH Addenda Notices: Everything Explained

What is an ACH addenda notice? It’s an essential part of Automatic Clearing House (ACH) payments, giving extra details needed to identify payments.

Businesses use ACH payments to transfer money electronically between banks in the U.S. They’re popular because they’re fast, secure, and have low fees.

An addenda record in ACH payments is like a detailed memo. It gives extra information about a transaction that helps with payment identification and reconciliation.

Key Points:

- An ACH addenda notice gives extra payment details.

- Used for identifying payments and keeping accurate records.

- Improves communication and simplifies the reconciliation process.

Addenda records are vital, especially when dealing with multiple payments. They provide the additional data required to match payments to invoices or accounts. This ensures smooth and accurate financial operations.

What is an ACH Addenda Notice?

An ACH addenda notice is a special type of record that accompanies an ACH payment. It provides extra information about the transaction, which can be crucial for accurate payment identification and reconciliation.

When you look at your bank statement, you might see a line item that includes an ACH addenda notice. This notice contains payment-related information that helps both the sender and receiver understand the details of the transaction. Think of it as a memo attached to the payment, offering more context.

Key Features of an ACH Addenda Notice

-

NACHA Compliance: The addenda notice follows the standards set by the National Automated Clearing House Association (NACHA). This ensures that the information is consistent and easy to understand across different financial institutions.

-

ASCII File Format: The addenda information is stored in an ASCII file format, which is a simple text format that computers can easily read and process.

-

94 Characters: Each line in the addenda record is exactly 94 characters long. This standard length helps maintain uniformity and ensures that all necessary details are included.

Real-World Example

Imagine a company that needs to pay multiple invoices in a single transaction. The ACH addenda notice can include details like invoice numbers and amounts, making it easier for the receiving company to match the payment with the correct invoices.

Why It Matters

The extra information provided by an ACH addenda notice can make a big difference in your financial operations. It helps:

- Identify Payments: Easily match payments to invoices or accounts.

- Keep Accurate Records: Maintain detailed records for future reference.

- Simplify Reconciliation: Make the reconciliation process quicker and more accurate.

In summary, an ACH addenda notice is a small but powerful tool that adds clarity and precision to your financial transactions.

Understanding ACH Payments

Before diving into ACH addenda notices, understand the foundation they are built on: ACH payments.

What Are ACH Payments?

ACH (Automated Clearing House) payments are electronic bank-to-bank payments processed through the ACH network in the United States. They are a popular choice for businesses due to their efficiency and cost-effectiveness.

Types of ACH Payments

There are two primary categories of ACH payments:

- Direct Deposits: These include payroll, tax refunds, and other types of credits to a bank account.

- Direct Payments: These are used for transactions like bill payments, mortgage loans, and other debits from a bank account.

Benefits of ACH Payments

ACH payments offer several advantages:

- Low Fees: Compared to credit card transactions, ACH payments usually have much lower processing fees.

- Reduced Risk: They minimize the risk of involuntary churn, as they don’t rely on card expiration dates or changes in card information.

- Bank-to-Bank Transfers: ACH payments are direct transfers between banks, which adds an extra layer of security and reliability.

Processing Time

ACH payments generally take around three working days to process. This makes them slower than some other payment methods, but their benefits often outweigh the delay.

In the next section, we’ll explore the different types of ACH addenda records and how they enhance the functionality of ACH payments.

Types of ACH Addenda Records

When it comes to ACH addenda records, there are a few key types to be aware of: CCD+ and CTX. Each type serves a unique purpose and offers different capabilities.

CCD+ Addenda Records

CCD+ (Corporate Credit or Debit Plus) is designed for corporate payments. It allows for a single addenda record to accompany the main transaction. This addendum can include up to 80 characters of free-form text, which is often used to provide details like invoice numbers or payment references.

Example:

Imagine a company paying a vendor. The CCD+ addenda record might include the invoice number and the date of the service. This helps both parties reconcile the payment more easily.

CTX Addenda Records

CTX (Corporate Trade Exchange) is more advanced and flexible. It supports up to 9,999 addenda records per transaction. This makes CTX ideal for complex transactions that require detailed information.

Example:

A company might use CTX to pay multiple invoices in a single transaction. Each addendum record can include details for a different invoice, such as the invoice number, amount, and order details.

Corporate Trade Exchange (CTX) in Detail

The CTX format was adopted to streamline business-to-business payments. It allows for comprehensive record-keeping and can handle multiple invoices in one go. This was a significant improvement over the older Corporate Trade Payment (CTP) system, which was phased out in the late 1990s.

Quote:

“The CTX system allows for tracking of payments along with comprehensive record-keeping for each payment, allowing for multiple invoices to be covered in the same payment.” – Investopedia

Real-World Application

The federal government initially adopted CTX to process large volumes of identical payments, such as Social Security checks. Today, businesses use it for everything from paying suppliers to managing payroll.

Fact:

CTX can also be used for both debits and credits, making it versatile for various types of transactions. The system uses the ANSI X12 standard for electronic data interchange, ensuring compatibility and reliability.

In the next section, we’ll delve into the benefits of using ACH addenda records, including how they simplify payment identification and reconciliation.

Benefits of Using ACH Addenda Records

ACH addenda records offer a variety of benefits that can streamline your financial operations. Let’s break down some of the key advantages:

Supplemental Information

ACH addenda records act like detailed memos. They provide supplemental information that helps identify the purpose of a payment. For example, if you’re making a payment to a vendor, you can include an invoice number or purchase order details in the addenda record. This extra information can be crucial for both the sender and the receiver.

Payment Identification

One of the primary uses of ACH addenda records is payment identification. According to Nacha, these records help identify the account holder or provide payment information to the receiver. This is especially useful in corporate environments where multiple payments are processed daily.

Record-Keeping

Keeping accurate records is essential for any business. ACH addenda records simplify record-keeping by providing a structured way to include transaction details. This makes it easier to track payments and ensures that all necessary information is stored in one place.

Reconciliation

Reconciliation is a critical part of accounting. ACH addenda records make the reconciliation process much easier. By including detailed payment information, you can quickly match payments with invoices or other financial documents. This reduces the time spent on manual reconciliation and minimizes errors.

Communication

ACH addenda records improve communication between financial institutions. Both the sending and receiving banks can use the information in the addenda to better understand the transaction. This helps in resolving any issues more quickly and ensures that payments are processed smoothly.

Traceability

Finally, ACH addenda records offer enhanced traceability. With detailed payment information, it’s easier to trace back any issues or discrepancies. This is particularly useful for audits or when investigating any potential fraud.

In summary, ACH addenda records provide valuable supplemental information, simplify payment identification, improve record-keeping, aid in reconciliation, enhance communication, and offer greater traceability. These benefits make them an essential tool for businesses dealing with numerous ACH transactions.

Next, we’ll explore the standard format of ACH addenda records and how you can use them effectively.

ACH Addenda Record Format

When it comes to ACH addenda records, understanding the format is key to using them effectively. The Nacha format is the standard for these records, and it’s essential for compliance and smooth processing.

CCD+ Format

The CCD+ format is often used for corporate payments. It allows for a single addenda record to be attached to each transaction. This addenda record can hold up to 80 characters of free-form text. This text is used to provide payment-related information such as invoice numbers, transaction references, or any other pertinent details.

Here’s a simple breakdown of the CCD+ addenda record format:

| Field | Type | Length | Description |

|---|---|---|---|

| Record Type Code | Numeric | 1 | Always “7” |

| Addenda Type Code | Numeric | 2 | Always “05” |

| Payment Related Information | Alphanumeric | 80 | Free-form text for payment details |

| Addenda Sequence Number | Numeric | 4 | Sequence number for the addenda |

| Entry Detail Sequence Number | Numeric | 7 | Corresponds to the entry detail record |

CTX Format

The CTX format is more robust and is used for transactions that require more detailed information. Unlike CCD+, the CTX format can include up to 9,999 addenda records. This makes it ideal for complex transactions involving multiple invoices or order details.

Each addenda record in the CTX format also follows a structured layout, similar to CCD+, but allows for more extensive data:

| Field | Type | Length | Description |

|---|---|---|---|

| Record Type Code | Numeric | 1 | Always “7” |

| Addenda Type Code | Numeric | 2 | Always “05” |

| Payment Related Information | Alphanumeric | 80 | Free-form text for payment details |

| Addenda Sequence Number | Numeric | 4 | Sequence number for the addenda |

| Entry Detail Sequence Number | Numeric | 7 | Corresponds to the entry detail record |

Free-Form Text

One of the significant aspects of both CCD+ and CTX formats is the free-form text field. This field, which allows up to 80 characters, is where you include the payment-related information. It can be anything from an invoice number to a brief note explaining the transaction. This flexibility helps in providing clear and concise details about the payment, making reconciliation and record-keeping much easier.

Understanding these formats and how to utilize the free-form text fields effectively can greatly enhance your ACH transaction processes. Next, we’ll discuss how to add these records to your ACH payments and ensure compliance.

How to Use ACH Addenda Records

Adding Addenda

To add an ACH addenda record, you need to include specific payment details. This often involves adding extra information like invoice numbers, transaction reference numbers, or notes that explain the purpose of the payment. For example, if you’re paying a supplier, you might include the invoice number and a brief description of the goods or services received.

Adding this information is straightforward. Most ACH software platforms, including Routable, provide easy-to-use interfaces for entering addenda details. Simply fill in the required fields, and the software will attach the addenda record to your ACH transaction.

Payment Details

Including detailed payment information in your ACH addenda records is crucial. It helps both the sender and receiver identify and reconcile transactions quickly. For instance, if you’re making a bulk payment to several vendors, you can use addenda records to specify how much of the total payment goes to each vendor and which invoices are being paid.

By providing this level of detail, you minimize confusion and ensure that all parties have a clear understanding of the transaction.

Compliance is a significant concern when dealing with ACH transactions. Ensuring your addenda records meet Nacha standards is vital for avoiding errors and potential penalties. Nacha rules specify that each addenda record must follow a specific format, and non-compliance can result in transaction failures.

Using a tool like ACH Genie can help. It automatically checks your ACH files for compliance, ensuring that all addenda records are correctly formatted and contain the necessary information.

Fraud Mitigation

ACH addenda records can also play a role in fraud mitigation. By including detailed information about each transaction, you create a transparent trail that can be audited. This makes it easier to spot any discrepancies or unauthorized changes.

For example, if an unexpected transaction appears, the detailed addenda record can help identify whether it was a legitimate payment or potentially fraudulent activity. This added layer of security is invaluable for businesses handling large volumes of transactions.

Next, we’ll address some frequently asked questions about ACH addenda notices, including how to interpret them on a bank statement and examples of common addenda records.

Frequently Asked Questions about ACH Addenda Notices

What is an ACH addenda notice on a bank statement?

An ACH addenda notice on a bank statement is a piece of supplemental information attached to an ACH payment. This notice provides extra details about the transaction, such as payment-related information and identification of the account holder.

Think of it as a memo that travels with the payment, helping both the sender and receiver understand the specifics of the transaction. It’s especially useful for businesses that need to reconcile payments accurately.

What is an example of an ACH addenda notice?

An ACH addenda notice might include information like an invoice number or a transaction reference number. For instance, if a company pays a vendor through an ACH transfer, the addenda record could contain the invoice number that the payment is meant to settle.

Here’s a simple example:

Invoice Number: 12345

Transaction Reference: ABC67890

This way, both the payer and the payee can easily match the payment to the correct invoice, making the reconciliation process straightforward.

What are the benefits of using ACH addenda records?

Using ACH addenda records offers several key benefits:

-

Supplemental Data: They provide additional transaction details, making it easier to identify and track payments.

-

Payment Identification: Addenda records help in identifying the purpose of the payment, such as which invoice or order it relates to.

-

Reconciliation: They simplify the reconciliation process for accounting teams by clearly linking payments to specific transactions.

-

Communication: These records improve communication between financial institutions by ensuring all necessary payment information is included.

By using ACH addenda records, businesses can maintain accurate financial records, reduce errors, and improve overall efficiency in their payment processes.

Next, let’s explore how to use ACH addenda records effectively in your transactions.

Conclusion

At ACH Genie, we understand the importance of efficient and accurate ACH transactions for financial institutions. Our services focus on ACH file editing and validation, ensuring every transaction meets the stringent standards required by the ACH network.

ACH File Editing and Validation

Errors in ACH files can lead to payment rejections, causing delays and disrupting cash flow. Our tools help you edit and validate ACH files to minimize these errors. By ensuring your files are compliant with Nacha standards, we help you avoid common pitfalls and streamline your payment processes.

Supporting Financial Institutions

Financial institutions process thousands of transactions daily. With the vast quantity of data, the potential for errors is high. Our solutions are designed to reduce these errors, ensuring smooth and efficient transactions. We also offer tools for ABA number validation, which is crucial for accurate routing of payments.

Reducing Payment Rejections

Payment rejections can be a major headache. They lead to delays, financial losses, and can damage business relationships. Our services help you identify and resolve common errors in NACHA files, reducing the chances of payment rejections and ensuring your transactions are processed smoothly.

The Future of ACH Transactions

As the financial landscape evolves, so do the tools and standards for ACH transactions. By partnering with ACH Genie, you can stay ahead of these changes and ensure your payment processes are as efficient and error-free as possible.

For more details on how we can help you with ACH addenda and other payment solutions, visit our ACH Addenda page.

With ACH Genie, you can ensure your ACH transactions are accurate, efficient, and compliant. Let us help you simplify your payment processes and reduce errors today.