Categories: ACH Validation

Top 6 ACH Dishonored Return Codes to Avoid in 2024

Understanding ACH Dishonored Return Codes

When financial institutions deal with ACH dishonored return codes, it can be a frustrating experience. These codes indicate that a previously returned ACH payment has encountered an issue, leading to another return. These issues can be due to mishandling, processing errors, or rule violations as per NACHA guidelines.

If you’re searching for a quick answer about ACH dishonored return codes, here it is: Dishonored returns occur when a return entry cannot be processed correctly, often due to timing, routing errors, or duplicate submissions. These codes are essential for maintaining the accuracy and reliability of the ACH network. NACHA is the organization that sets the standards and rules for these transactions.

Key Points:

- ACH Dishonored Return: A previously returned ACH payment that is returned again due to specific errors.

- NACHA Rules: Ensure proper processing of ACH payments; mishandled returns violate these rules.

- Financial Institutions: Must manage and correct these returns promptly to avoid penalties.

Let’s dive deeper into the meaning and implications of ACH dishonored return codes.

What is a Dishonored Return in ACH?

A dishonored return in ACH is essentially a returned payment that gets returned again due to a specific issue. It’s like a double rejection. This usually happens when there’s a mistake in the way the return was handled the first time.

ODFI vs. RDFI

- ODFI: Originating Depository Financial Institution. This is the bank that initiates the transaction.

- RDFI: Receiving Depository Financial Institution. This is the bank that receives the transaction.

Mishandled Returns

Dishonored returns usually occur because of mishandling by either the ODFI or RDFI. Mishandling can involve several types of errors, including:

-

Untimely Returns: The return wasn’t sent back within the timeframe set by NACHA rules. For example, an ODFI has five banking days to dishonor a return. If they miss this window, it becomes an untimely return, coded as R72.

-

Misrouted Returns: Sometimes, the return is sent to the wrong financial institution. This might happen if the incorrect routing number is used. This is coded as R61.

-

Incorrect Information: Returns can be dishonored if there are errors in the data fields. For instance, if the wrong amount is entered or if the entry has invalid account details. This is where codes like R69 (Field Errors) come into play.

Real-World Example

Imagine you’re a business owner who receives a returned payment due to insufficient funds. You fix the issue and resubmit the transaction, but it gets returned again because the ODFI didn’t process your resubmission within the required timeframe. This would be an untimely dishonored return.

Key Takeaways:

- Dishonored returns complicate the transaction process and can lead to delays and penalties.

- ODFI and RDFI need to follow strict NACHA guidelines to avoid these issues.

- Common errors include untimely returns, misrouted returns, and incorrect information.

Understanding these aspects can help you manage and resolve ACH dishonored returns more effectively. Next, let’s explore the common ACH dishonored return codes you might encounter.

Common ACH Dishonored Return Codes

ACH dishonored return codes tell you why a return was not processed correctly. Here are some common ones you might see:

R61 – Misrouted Return

R61 means the return was sent to the wrong ODFI. This happens when the routing number is incorrect. For example, if you send a return to Bank A but it should go to Bank B, you’ll get an R61 code.

R67 – Duplicate Return

R67 indicates that the same entry was returned more than once. This code shows up if multiple returns are processed for the same transaction. To fix this, check your records to ensure returns aren’t repeated.

R68 – Untimely Return

R68 means the return wasn’t sent within the required timeframe. According to NACHA rules, returns must be processed within a specific period. For instance, if you miss the five banking days window, you’ll get an R68 code.

R69 – Field Errors

R69 happens when there are errors in the return fields. This could be incorrect information like the Original Entry Trace Number, Amount, or Company Identification. Double-check these fields to avoid this code.

R70 – Permissible Return Not Accepted

R70 means the ODFI did not accept a permissible return. This usually involves CCD or CTX entries. If the ODFI has not agreed to accept the return, you’ll see an R70 code.

R77 – Non-Acceptance of R62 Dishonored Return

R77 occurs when the RDFI returns both the erroneous entry and the related reversing entry, or the funds relating to the R62 dishonored return are not recoverable from the Receiver. This needs to be addressed within two banking days of the settlement date of the dishonored return entry.

Understanding these codes helps you manage ACH transactions better and ensures smoother financial operations. Next, we’ll discuss how to handle ACH dishonored returns effectively.

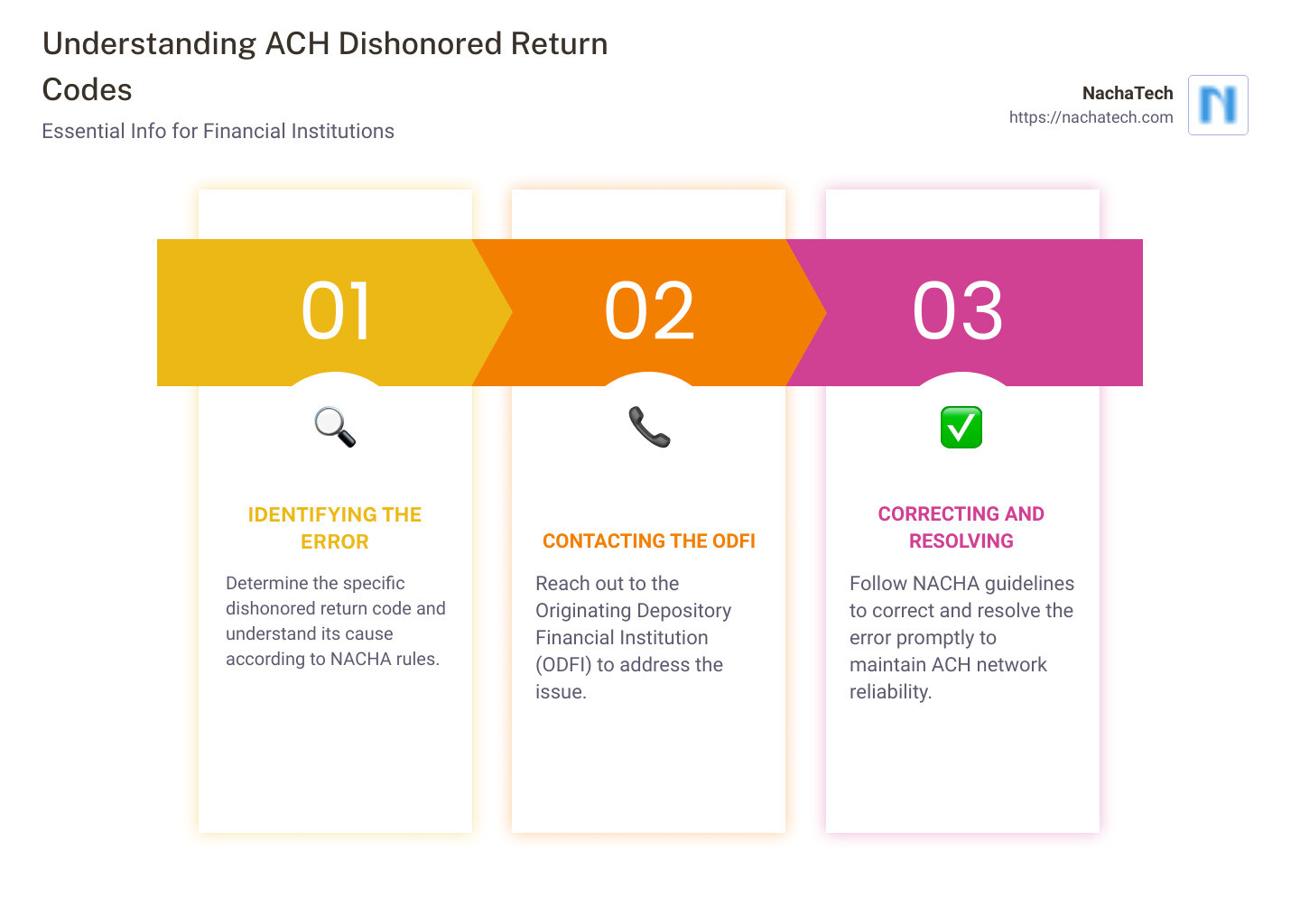

How to Handle ACH Dishonored Returns

Handling ACH dishonored returns effectively ensures smoother financial operations and compliance with NACHA guidelines. Here’s a step-by-step guide to navigate through this process:

Contact the ODFI

When you encounter a dishonored return, your first step should be to contact the Originating Depository Financial Institution (ODFI). The ODFI is responsible for initiating the transaction and can provide crucial information about the return.

Example: If you receive an R72 code, which indicates an untimely dishonored return, contact the ODFI’s ACH operations group. They can help verify the timeframe and guide you on the necessary steps.

Utilize the ACH Operations Group

Most ODFIs have a dedicated ACH operations group. This team specializes in handling ACH transactions and can assist you in resolving issues promptly. Make sure to have all relevant transaction details on hand when you reach out to them.

Quote: “Our ACH operations group is equipped to handle any return code queries swiftly, ensuring minimal disruption to your transactions,” says a representative from a leading financial institution.

Adhere to Timeframes

Time is of the essence when dealing with ACH returns. Different return codes have specific timeframes within which they must be addressed. For instance:

- R68 – Untimely Return: The ODFI must dishonor the return within five banking days from the settlement date of the returned transaction.

- R77 – Non-Acceptance of R62 Dishonored Return: This must be addressed within two banking days of the settlement date of the dishonored return entry.

Failing to adhere to these timelines can result in further complications and potential financial losses.

Follow NACHA Guidelines

NACHA provides comprehensive guidelines for handling ACH transactions, including dishonored returns. Staying up-to-date with these rules is crucial for compliance and efficient transaction management.

Fact: According to NACHA, dishonored returns must be processed within the designated timeframes to avoid penalties and ensure smooth financial operations.

By following these steps—contacting the ODFI, leveraging the ACH operations group, adhering to timeframes, and following NACHA guidelines—you can effectively manage ACH dishonored returns and maintain seamless financial transactions.

Frequently Asked Questions about ACH Dishonored Return Codes

What is a dishonored return in ACH?

A dishonored return in ACH happens when a return entry is sent back to the Originating Depository Financial Institution (ODFI) but is rejected for some reason. Common causes include mishandled returns, untimely returns, or incorrect information. For instance, if the Receiving Depository Financial Institution (RDFI) sends a return but it has errors or misses the deadline, the ODFI can dishonor it.

What are the ACH return codes?

ACH return codes are three-character codes used to indicate why an ACH payment failed. These codes help businesses understand the specific issue with a transaction. For example, R01 means “Insufficient Funds,” while R03 indicates “No Account/Unable to Locate Account.” There are over 80 such codes, each providing clarity on the nature of the problem. Staying updated with these codes and guidelines from NACHA can help in managing returns efficiently.

What is the return code for a dormant ACH account?

The return code for a dormant or inactive ACH account is R03. This code signifies “No Account/Unable to Locate Account,” which can happen if the account in question is no longer active or has been closed. To resolve an R03 return, you should contact the customer to confirm the account details and ensure the account is active before resubmitting the payment.

Conclusion

At ACH Genie, we understand how crucial it is for businesses to have smooth financial transactions. ACH return codes, especially ACH dishonored return codes, can be a significant hurdle if not managed correctly. That’s why our services focus on ACH file validation to help you navigate these challenges seamlessly.

Financial technology is evolving rapidly, and staying updated with the latest NACHA rules is essential. Our tools are designed to keep you compliant and minimize rejections. By automating the validation process, we ensure that your ACH files are accurate and meet all regulatory requirements.

Incorporating our solutions can drastically eliminate rejections, saving you time and money. Our commitment to providing top-notch financial technology solutions means you can focus on what matters most—growing your business.

For more information on how ACH Genie can help you handle ACH transactions more efficiently, visit our ACH Payments page.

We’re here to help you succeed in the complex world of ACH transactions.