Categories: ACH Validation

How to Pre-Validate Bank Account: Top Steps in 2024

Introduction

When it comes to managing your finances, how to pre validate bank account is a necessary step for ensuring smooth operations, especially for income tax returns. Pre-validating your bank account allows you to:

- Receive income tax refunds directly to your bank.

- Enable Electronic Verification Code (EVC) for secure transactions.

- Avoid delays and errors in financial operations.

Overview

Pre-validating your bank account on income tax portals is a straightforward process that is vital for all registered taxpayers. With a valid PAN and bank account, you can secure seamless electronic transactions and timely tax refunds.

Importance:

– Direct Refunds: Your income tax refunds are directly credited to the verified bank account, making the process faster and more reliable.

– Enhanced Security: Pre-validating your account ensures that all financial transactions are secure and reduces the risk of fraud.

– EVC Enablement: This allows the use of an Electronic Verification Code (EVC) for online verification and transactions, adding an extra layer of security.

Benefits:

– Faster Refunds: Pre-validation ensures quicker processing of tax refunds.

– Error Minimization: It helps minimize errors related to incorrect bank details.

– Secure Transactions: Ensures that sensitive financial transactions are carried out securely.

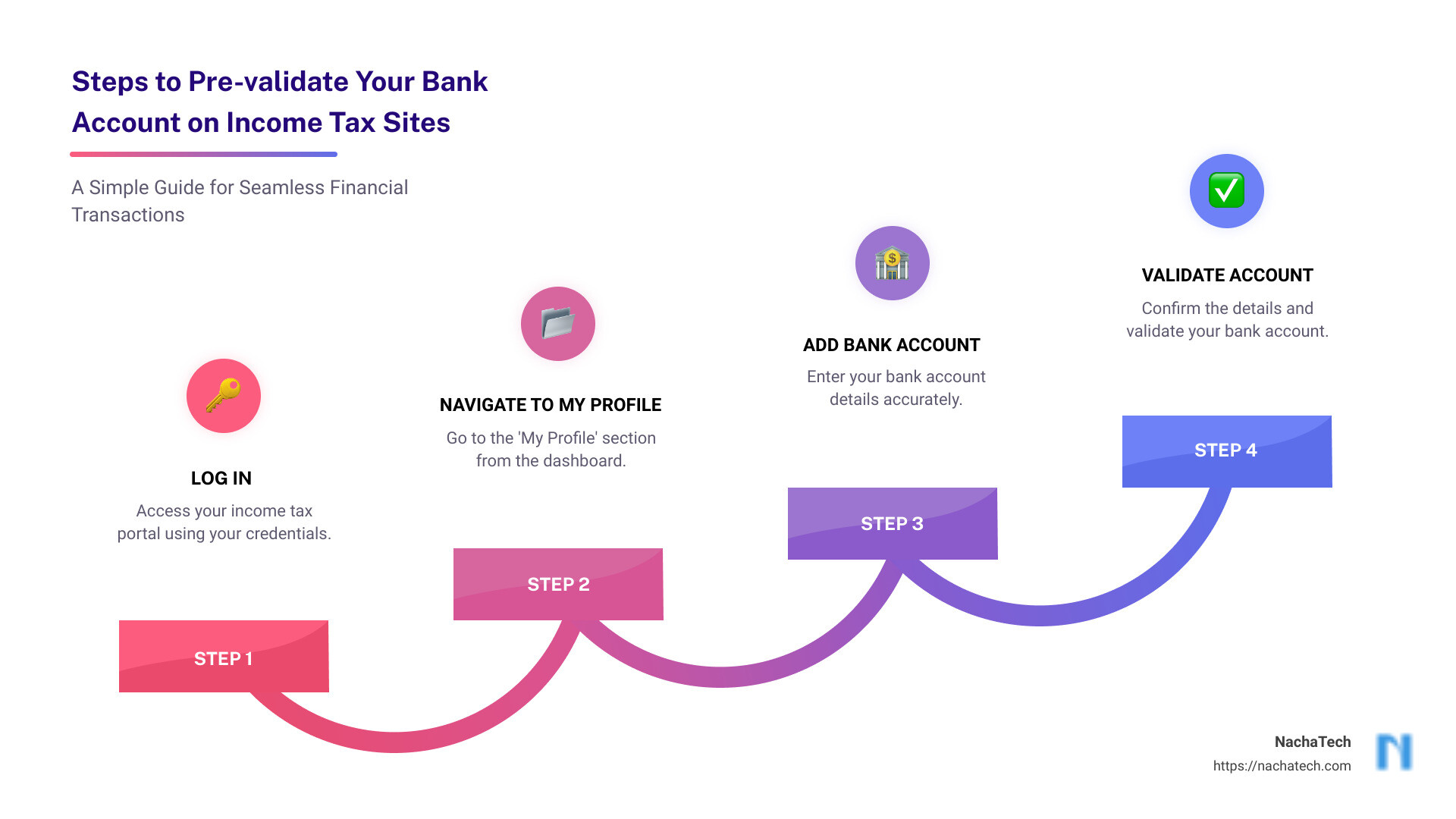

How to Pre-Validate Your Bank Account on Income Tax Portals

Step-by-Step Guide to Pre-Validation

Pre-validating your bank account on income tax portals is essential for receiving tax refunds and using the Electronic Verification Code (EVC) for secure transactions. Here’s a simple step-by-step guide on how to pre-validate your bank account:

Login Steps

- Log in to the e-Filing Portal:

- Visit the Income Tax Department’s e-filing website.

- Log in using your user ID and password. If you are a new user, you will need to register first.

Profile Navigation

- Access Profile Settings:

- Once logged in, click on your profile or user account located at the top right corner of the screen.

- From the dropdown menu, select ‘Profile Settings.’

Bank Details Entry

- Add Bank Account:

- Under ‘Profile Settings,’ choose the option to ‘Pre-Validate Your Bank Account’ or ‘Bank Account E-Verification.’

- Enter the required bank details such as bank name, account number, IFSC code, and the mobile number registered with the bank.

Validate Account

- Validate Account:

- Validation can be done via Electronic Verification Code (EVC) or Net Banking:

- EVC Option: If your mobile number and bank account are linked to Aadhaar, select this option. You will receive an OTP on your mobile. Enter this OTP on the portal to validate your account.

- Net Banking Option: If Net Banking is enabled for your account, the portal will redirect you to the bank’s site. Log in and complete the validation process there.

Confirmation

- Successful Validation:

- After completing the validation process, you will receive a confirmation message.

- Your bank account is now successfully added and validated for income-tax purposes.

By following these steps, you ensure that your bank account is ready to receive tax refunds and is set up for secure transactions. This process helps avoid delays and ensures that your financial dealings with the Income Tax Department are smooth and error-free.

Common Challenges and Solutions in Bank Account Pre-Validation

Troubleshooting Common Errors

Even after following all the steps, you might encounter some common errors during the bank account pre-validation process. Don’t worry, here are the solutions to help you overcome these challenges:

Validation Errors

Name Mismatch

– Problem: The name on your PAN card does not match the name registered with your bank account.

– Solution: Update the name on your PAN or bank records to ensure they match. You can do this by visiting your bank or using their online services.

PAN Linkage

– Problem: PAN is not linked with the bank account.

– Solution: Visit your bank to link your PAN with the bank account. Once linked, you can re-submit the request for validation on the income tax portal.

Invalid IFSC

– Problem: The IFSC code entered is incorrect or outdated due to bank mergers.

– Solution: Double-check the IFSC code with your bank or use the bank’s official website to find the correct code. Enter the correct IFSC and re-validate.

Account Type Restrictions

– Problem: The account type selected is not eligible for validation (e.g., Fixed Deposit or Recurring Deposit).

– Solution: Ensure that you select an eligible account type such as Savings, Current, Cash Credit, Overdraft, or Non-Resident Ordinary (NRO).

Bank Integration

Sometimes, your bank might not be integrated with the e-filing portal. This can cause issues in the validation process.

Manual Verification

– Solution: You may need to manually verify your bank account by providing additional documentation to the entity requesting the validation. Contact your bank for specific instructions.

Contact the Bank

– Solution: Reach out directly to your bank to inquire about their process for validating accounts that are not integrated with the e-filing system.

EVC Issues

Primary Mobile Number and Email ID

– Problem: The mobile number or email ID linked with your bank account does not match the details on the e-filing portal.

– Solution: Update your contact details either on the e-filing portal or with your bank to ensure they match. Once updated, revalidate your bank account.

Single EVC-Enabled Account

– Problem: You can only enable EVC for one bank account at a time.

– Solution: If you wish to enable EVC for a different account, you must first disable it for the currently enabled account.

Revalidation for Failed Accounts

If your bank account validation fails, the reasons can vary. Here’s a quick guide to address common issues:

| Reason for Failure | Action to be Taken |

|---|---|

| PAN not linked with bank account | Link the PAN with the bank account and click Re-Validate. Contact your branch for further information. |

| PAN mismatch | Correct the PAN in the bank records and click Re-Validate. |

| Invalid account type | Select the correct account type and click Re-Validate. |

| Invalid IFSC | Enter the correct IFSC and click Re-Validate. |

| Account closed | Use a different bank account number and try again. |

| Zero balance / Inactive account | Use a different active bank account number. |

| Litigated account | Use a different bank account number. |

| Account holder name invalid | Update the name as per PAN and click Re-Validate. |

| Account frozen or blocked | Use a different bank account number. |

By addressing these common issues, you can successfully pre-validate your bank account and ensure smooth financial transactions with the Income Tax Department.

Next, let’s explore the benefits of pre-validating your bank account for tax purposes.

Benefits of Pre-Validating Your Bank Account for Tax Purposes

Why Pre-Validation is Crucial for Tax Refunds

Faster Refunds: When you pre-validate your bank account, the Income Tax Department can process your refund more quickly. This is because the system already has your verified bank details, eliminating delays caused by incorrect or unverified information.

Secure Transactions: Pre-validating your bank account ensures that your tax refunds and other transactions are directed to the correct account. This minimizes the risk of errors and fraud, making your financial dealings with the tax department more secure.

EVC Benefits: An Electronic Verification Code (EVC) is a secure way to verify your identity when filing tax returns. By pre-validating your bank account, you can use it to generate an EVC, which can be used for e-Verifying Income Tax Returns, e-Proceedings, and more. This adds an extra layer of security and convenience.

Direct Credit: Pre-validating your bank account allows the Income Tax Department to directly credit your refunds into your account. This is faster and more efficient than receiving refunds through cheques or other methods.

Mandatory Requirement: From March 1, 2019, the Income Tax Department has mandated that all refunds will be issued only through electronic mode to pre-validated bank accounts. If your account is not pre-validated, you won’t receive your refund.

E-Verification: Pre-validating your bank account is essential for e-Verification. This is a quick and secure way to verify your tax returns and other forms without the need for physical documents. It simplifies the entire tax filing process and makes it more efficient.

By pre-validating your bank account, you ensure faster, more secure, and hassle-free transactions with the Income Tax Department. This not only speeds up your refund process but also adds a layer of security to your financial dealings.

Next, let’s dive into frequently asked questions about pre-validating bank accounts.

Frequently Asked Questions about Pre-Validating Bank Accounts

What happens if pre-validation fails?

If your pre-validation attempt fails, don’t worry. You’ll receive a notification about the failure, and the details will be displayed under the Failed Bank Accounts section in your e-Filing portal. Common reasons for failure include:

- PAN not linked with the bank account: Link your PAN with your bank account and click Re-Validate. Contact your bank branch for assistance.

- Name mismatch: Ensure the name on your bank account matches your PAN. Update the name at your bank if needed, then re-validate.

- Invalid account type: Make sure you’re using a valid account type like Savings, Current, Cash Credit, Overdraft, or NRO. Update the account type and re-validate.

- Invalid IFSC: Enter the correct IFSC code and re-validate.

- Account closed or inactive: Use a different bank account number and re-validate.

You’ll need to correct the issue and resubmit the request for validation. For detailed steps, refer to the Income Tax e-Filing portal.

How long does the pre-validation process take?

The pre-validation process is generally automatic and quite efficient. Once you submit your request, it is sent to your bank for verification. Typically, the validation status is updated in your e-Filing account within 10-12 working days.

You’ll receive updates on the validation status via your registered mobile number and email ID. If the process takes longer, it might be due to specific issues with your bank or account details. In such cases, follow up with your bank branch for further assistance.

Can I pre-validate multiple bank accounts?

Yes, you can pre-validate multiple bank accounts. This is especially useful if you want to nominate more than one account for receiving Income Tax refunds. However, keep in mind:

- EVC (Electronic Verification Code) can only be enabled for one bank account at a time. If you try to enable EVC for another account, you will be prompted to disable it for the existing account.

- All nominated accounts must have the status Validated.

To manage your validated accounts, simply navigate to the Added Bank Accounts section in your e-Filing profile. Here, you can see the status of each account and make necessary changes.

Pre-validating your bank accounts ensures smooth transactions and faster refunds, making your tax filing experience more efficient and secure.

Next, we’ll explore the benefits of pre-validating your bank account for tax purposes.

Conclusion

How ACH Genie Can Assist

Pre-validating your bank account on income tax portals is crucial for ensuring smooth transactions and faster refunds. By following the steps outlined, you can avoid common pitfalls and make your tax filing experience more efficient and secure.

However, we understand that navigating the complexities of bank account validation can be challenging. This is where ACH Genie comes into play.

ACH Genie specializes in financial technology solutions that simplify and streamline ACH file validation. Our state-of-the-art software helps businesses and individuals manage their ACH transactions seamlessly, ensuring that potential errors are caught and corrected before they cause disruptions.

How We Help:

-

Error Handling: ACH Genie effectively identifies and rectifies major errors in ACH files, preventing payment rejections and ensuring smooth transactions.

-

Raw Line Editing: Our unique feature allows for flexible modifications that adhere to NACHA standards, making it easier to manage your ACH files.

-

Fast ABA Number Validation: With an embedded ABA database, ACH Genie facilitates swift validation of ABA numbers, reducing the chances of transaction failures.

Incorporating ACH Genie’s solutions into your financial processes can save you time and reduce the hassle associated with bank account validation. Whether you’re a business or an individual, our tools are designed to make your financial transactions as seamless as possible.

For more information on how ACH Genie can assist you with ACH file validation, visit our service page.

By leveraging ACH Genie’s expertise, you can ensure that your bank accounts are pre-validated correctly, minimizing errors and maximizing efficiency in your financial dealings.