Categories: NACHA File Format

ACH Data Format: Top 10 Essential Tips for 2024 Success

Introduction

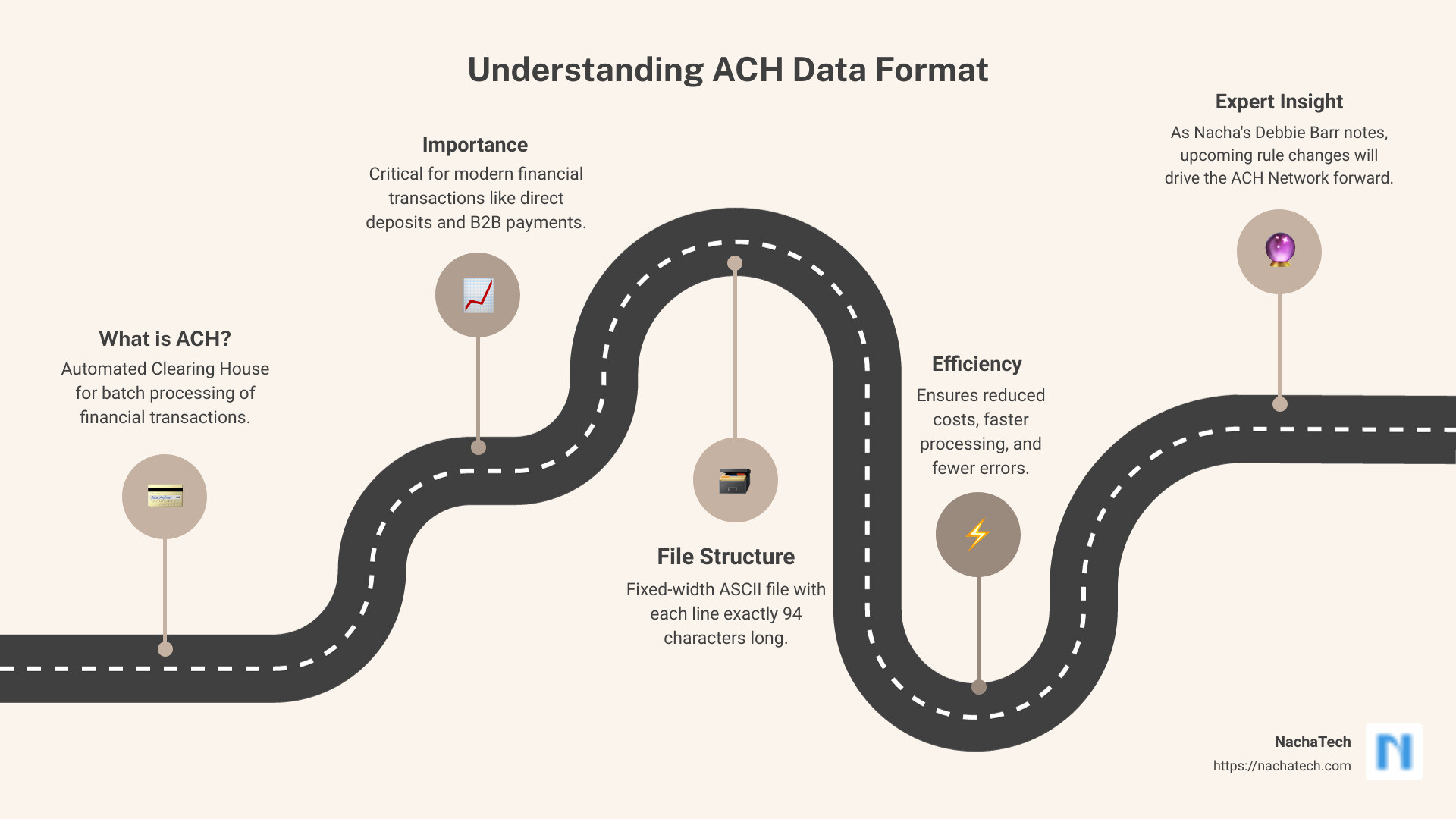

If you’re looking for a quick overview, here’s what you need to know about the ACH data format:

- ACH stands for Automated Clearing House.

- It’s a fixed-width, ASCII file, with each line exactly 94 characters long.

- The ACH file facilitates batch processing of financial transactions.

The ACH data format is a critical component of modern financial transactions. It forms the backbone of systems that handle everything from direct deposits to B2B payments. This format ensures payments are processed efficiently and securely, providing benefits like reduced costs, faster processing times, and fewer errors.

In simple terms, an ACH file is a type of financial document used by banks and financial institutions to process multiple transactions at once. Understanding this format means businesses can streamline operations, avoid costly errors, and ensure smooth transactions. As Debbie Barr, Nacha Senior Director, says, “2021 is going to be a year full of some great Rules changes, things that help drive our ACH Network forward.”

This article will help you master the ACH file format, explaining its structure and key components, and offering tips for avoiding common errors. Let’s dive in to understand how this simple, standardized format is pivotal to the financial world.

Understanding the ACH Data Format

ACH files might seem complex at first, but they follow a clear, structured format that ensures smooth processing of transactions. Let’s break down the key components and structure to help you master the ACH data format.

The Role of the File Header and Control Records

File Header Record

The ACH file starts with the File Header Record, identified by the digits 101. This record sets the stage by providing essential information such as:

- The routing number of the originating bank

- A timestamp for the transaction

- The name of the originating bank and company

This record ensures that the file is recognized and processed correctly by the receiving system.

File Control Record

At the end of the ACH file, the File Control Record (identified by 9) acts as a final check. It includes:

- Counts of all records

- The total number of entries and addenda

- Debit and credit totals

This record verifies the integrity of the file, ensuring that all transactions are accounted for and that the totals match.

Detailing the Batch Header and Control Records

Batch Header Record

Each batch within the ACH file begins with a Batch Header Record, starting with 5. This record details:

- The type and purpose of transactions (e.g., payroll, vendor payments)

- The company ID and name

- A description of the transactions (e.g., “salary” or “bonus”)

- The effective date for the transactions

Each batch groups transactions that share similar characteristics, ensuring organized and efficient processing.

Batch Control Record

The Batch Control Record, starting with 8, closes each batch. It summarizes:

- The count and dollar amount of all entries in the batch

- A hash total (checksum) to ensure the batch’s validity

This record ensures that the batch is complete and that all entries are accurate.

Exploring Entry Detail and Addenda Records

Entry Detail Record

Each transaction within a batch is detailed in an Entry Detail Record, which starts with 6. This record includes:

- The receiver’s account name and number

- The transaction amount and type (debit or credit)

- A unique trace number for identification

For example, if you’re paying a vendor, this record will contain the vendor’s banking information and the payment amount.

Addenda Records

Sometimes, additional information is needed to describe a transaction. This is where Addenda Records come in, starting with 7. These records can provide extra details, such as invoice numbers or payment instructions, and are especially useful for corporate-to-corporate transactions.

Blocking Factor

The ACH file format also includes a blocking factor, which ensures that the file is structured in blocks of 10 records. This helps in efficient processing and validation of the file.

By understanding these components, you can better appreciate the structured nature of ACH files and how they ensure smooth, error-free transactions.

Let’s now move on to the key components of ACH files, where we’ll delve into service class codes, company identification, and SEC codes.

Key Components of ACH Files

Decoding Transaction and Addenda Codes

Transaction Codes and Addenda Record Indicators are crucial for accurate financial transactions. Transaction codes are two-digit numbers that tell you the type of account and transaction. For example, a ’22’ means a credit to a checking account, while a ’27’ means a debit from a checking account. These codes ensure that money goes where it’s supposed to go.

Addenda records provide extra details about a transaction. They can include information like invoice numbers or descriptions. An Addenda Record Indicator tells you if there’s additional information. A ‘0’ means no addenda, while a ‘1’ means there’s more info attached.

Importance of Effective Entry Date and Settlement Date

The Effective Entry Date and Settlement Date are dates that guide when transactions should happen. The Effective Entry Date is the date you want the transaction to occur, like a payday. It’s a six-digit number in the format YYMMDD.

The Settlement Date is when the transaction actually happens. This date is filled in by the bank. It’s crucial for ensuring that funds are available on the right day. Mistakes in these dates can lead to delays or rejections.

Service Class Codes

Service Class Codes categorize the types of transactions in a batch. They can be:

– 200 for mixed debits and credits

– 220 for all credits

– 225 for all debits

These three-digit codes help banks process transactions efficiently. Knowing the right class code for your batch ensures smooth processing.

Company Identification

Company Identification is a unique number that identifies the originator of the transaction. This is typically a 10-digit number and is vital for tracking and validation. It’s like a digital fingerprint for your company in the ACH network.

SEC Codes

Standard Entry Class (SEC) Codes describe the type of transactions in a batch. They indicate whether a transaction is consumer or corporate, single-entry or recurring. Here are some common SEC Codes:

- PPD: Used for direct deposits like payroll.

- CCD: Used for corporate payments.

- WEB: Used for online transactions.

- TEL: Used for telephone-initiated transactions.

Each SEC Code has specific rules and formats, so using the correct one is essential for compliance and smooth transactions.

By understanding these key components, you can master the ACH data format and ensure accurate and efficient financial transactions.

Next, we will look at common ACH file errors and how to avoid them.

Common ACH File Errors and How to Avoid Them

Tools for Validating and Editing ACH Files

Creating ACH files can feel like navigating a minefield. A single error can cause payment rejections, leading to financial loss and reputational damage. Here, we will look at common errors and how to avoid them.

Unbalanced Files

An unbalanced file lacks an offset record, causing debits and credits to be unequal. This imbalance can lead to failed transactions. For example, if your file has $1,000 in debits and $10,000 in credits, you need a $9,000 debit offset record.

To avoid this, always ensure your debits and credits balance by adding offset records. Group and total transactions by effective date to create multiple offset transactions if needed.

Incorrect Trace Numbers

Trace numbers, assigned by the Originating Depository Financial Institution (ODFI), must be ascending within a batch. Incorrect or duplicated trace numbers can disrupt the file.

Double-check trace numbers for accuracy and ensure they are ascending. Some software can automate this process, reducing human error.

Misaligned Record Types

Each record type in an ACH file has a specific format and position. Misaligned records can cause the entire file to fail. For instance, if an Entry Detail Record is placed where a Batch Header Record should be, the transaction will not process.

Always validate the structure of your ACH files. Use tools like ACH Genie to ensure records are correctly aligned and formatted.

ACH Genie for ACH File Validation

ACH Genie offers robust tools for validating and editing ACH files. Their platform can identify and resolve common errors, ensuring smooth processing of your ACH transactions. By validating your files through ACH Genie, you can catch issues like:

- Incorrect immediate destination and origin numbers

- Missing or inactive payee lists

- Misconfigured pre-note options

- Incorrect company identification and originating DFI identification

- File creation time and hash calculation errors

Using ACH Genie can save you time and prevent costly mistakes.

By understanding these common errors and using tools like ACH Genie for validation, you can master the ACH data format and ensure error-free transactions.

Next, we will discuss how to implement ACH file transfers in your business.

Implementing ACH File Transfers in Your Business

Case Studies: Effective ACH Implementation

Implementing ACH file transfers can revolutionize your business operations by integrating, automating, and securing your payment processes. Let’s explore some real-world examples and success stories.

Integration

QuickBooks Integration:

QuickBooks is one of the most popular accounting platforms. By integrating ACH file transfers, businesses can automate payroll and vendor payments. For example, InLattice connects with QuickBooks to upload invoices and process payments, creating a NACHA file for seamless bank transactions. This integration eliminates manual data entry and reduces errors.

NetSuite Integration:

NetSuite users can leverage the Electronic Bank Payments function to generate NACHA files. This tool automates the payment process, allowing for large batch payments with minimal manual intervention. Users report that the setup is user-friendly and significantly reduces processing time.

Automation

AP Automation Software:

Studies show that AP teams using automation software can increase efficiency by up to 60%. Tools like these streamline the entire accounts payable workflow by eliminating manual intervention. They convert payment files into NACHA format and send them directly to banks, ensuring real-time data sync and accurate record-keeping.

Payment Automation:

While payment automation software focuses on the payment step, it consolidates various payment methods into a single electronic file. This includes checks, ACH, wire transfers, and credit cards. This method ensures that each vendor is paid using the most advantageous method, saving time and reducing errors.

Security Measures

Account Validation:

Starting March 19, 2021, a new NACHA rule mandates that account validation is part of a “commercially reasonable fraudulent transaction detection system” for screening WEB debits. This ensures that businesses validate account numbers when used for the first time or when changes are made, enhancing security and reducing fraud.

Encryption and Access Control:

Given the sensitive nature of ACH files, it’s crucial to implement robust security measures. Encryption ensures data is secure during transfer. Access control measures, such as user permissions and audit trails, help prevent unauthorized access and modifications.

Real-world Examples

Case Study: A Retail Chain

A large retail chain implemented ACH file transfers to manage vendor payments. By integrating with their ERP system, they automated the creation and submission of NACHA files. This reduced their payment processing time by 50% and minimized errors, leading to smoother operations and better vendor relationships.

Case Study: A Healthcare Provider

A healthcare provider adopted AP automation software to handle patient refunds and vendor payments. The software converted payment files to NACHA format and sent them directly to their bank. This not only improved efficiency but also ensured compliance with healthcare regulations regarding secure data handling.

Success Stories

Increased Efficiency:

Businesses that implemented ACH file transfers reported significant improvements in efficiency. For instance, a manufacturing company saw a 40% reduction in payment processing time, allowing their finance team to focus on strategic tasks rather than manual data entry.

Cost Savings:

By switching to ACH payments, a logistics company saved over $20,000 annually in bank fees and paper check costs. The automation also enabled them to take advantage of early payment discounts offered by vendors, further boosting their savings.

Implementing ACH file transfers can transform your business by integrating, automating, and securing your payment processes. The success stories and case studies above highlight the tangible benefits of adopting this technology.

Next, we will answer some frequently asked questions about the ACH data format.

Frequently Asked Questions about ACH Data Format

What is an ACH file and how is it structured?

An ACH file is a fixed-width, ASCII file used to process electronic transactions through the Automated Clearing House (ACH) network. Each line, or record, is exactly 94 characters long and consists of various fields in specific positions. The file structure includes:

- File Header Record: Starts the file, contains basic info like the origin bank’s routing number.

- Batch Header Record: Starts each batch, includes details such as company ID and payment description.

- Entry Detail Record: Contains transaction specifics, like the receiver’s account number and transaction amount.

- Addenda Record: Optional, provides additional information for complex transactions.

- Batch Control Record: Ends each batch, sums up the count and dollar amount of all entries.

- File Control Record: Ends the file, includes counts for each type of entry.

Each record type is identified by a specific digit at the beginning of the line, making it easy to determine the record’s purpose.

How do you correct common ACH file errors?

ACH files can be prone to errors, but understanding these common issues can help you avoid them:

- Incorrect Immediate Destination and Origin Numbers: Double-check these numbers to ensure accuracy. Mistakes here can cause the file to fail.

- Missing or Inactive Payee List: Ensure the payee list is active and correctly assigned on the ACH Definition tab of the bank record.

- Incorrect Company Identification and Originating DFI Identification: Verify these values in the ACH Definition tab to avoid misidentification.

- File Creation Time and ACHBatchHash or ACHFileHash Calculation Errors: Update to the latest version of your ACH software to ensure correct padding and calculations.

Using tools like ACH Genie can help edit and validate your files, minimizing errors and avoiding rejections.

What are the security practices for handling ACH files?

Handling ACH files securely is crucial to protect sensitive financial data. Here are some best practices:

- Encryption: Always encrypt ACH files during transmission to prevent unauthorized access.

- Authentication: Use multi-factor authentication (MFA) for accessing systems that handle ACH files.

- Access Control: Limit access to ACH files to authorized personnel only.

- Regular Audits: Conduct regular audits to ensure compliance with security protocols.

- Secure Storage: Store ACH files in secure, access-controlled environments.

By following these practices, you can ensure the security and integrity of your ACH transactions.

Conclusion

As we ride the wave of digital transformation, the role of ACH transactions in financial operations is set to evolve significantly. In 2019 alone, the ACH network moved $55.8 trillion, and this number is only expected to grow.

Future of ACH Transactions

Looking ahead, ACH transactions are poised to become even more efficient and secure. One of the key changes on the horizon is the extension of the Same Day ACH window. Starting in 2021, an additional two hours will be added to the banking day for ACH transactions. This change will be particularly beneficial for west coast financial institutions, providing them with more flexibility and reducing the likelihood of return issues.

Moreover, new rules coming into effect will require rigorous account validation as part of a “commercially reasonable fraudulent transaction detection system” for screening WEB debits. This is a significant step towards enhancing the security and reliability of ACH transactions.

ACH Genie’s Role in ACH File Editing and Validation

At ACH Genie, we are committed to helping businesses navigate the complexities of ACH file formats. Our tools are designed to simplify the process of creating, editing, and validating ACH files, ensuring compliance with NACHA rules and reducing the risk of errors.

ACH Genie provides a suite of features that make managing ACH files easier:

- File Validation: Our software checks for common errors such as unbalanced files and incorrect trace numbers, helping you avoid costly mistakes.

- Editing Tools: Easily make changes to ACH files with our user-friendly interface.

- Automation: Streamline your workflow by automating the creation and transmission of ACH files.

- Security Measures: We prioritize the security of your data with encryption, authentication, and access controls.

By leveraging ACH Genie’s solutions, businesses can ensure their ACH transactions are accurate, secure, and compliant with the latest standards.

In conclusion, the future of ACH transactions looks promising, with advancements aimed at increasing efficiency and security. ACH Genie stands ready to support your business in adapting to these changes, providing the tools and expertise needed for seamless ACH file management.

For more information on how ACH Genie can help you master ACH file formats, visit ACH Genie.