Categories: NACHA File Validation

In the rapidly evolving world of digital transactions, staying compliant with regulatory requirements is essential for any financial institution. This is particularly relevant as Nacha – the governing body that oversees the electronic movements of money and data in the U.S – is set to implement a new account validation rule in 2024. The rule is aimed at enhancing protection against fraud, mitigating payment errors, and bolstering the overall integrity of ACH (Automated Clearing House) transactions.

For a financial institution like you grappling with ACH payment rejections and errors in NACHA files, understanding and adapting to this rule is paramount. It demands the institution to employ a commercially reasonable method to confirm whether an account number earmarked for a WEB debit entry is linked to a legitimate account. Failing to adhere can not only result in fines and penalties but can also undermine the trust of customers and stakeholders.

For an organization that’s striving to streamline its processes and ensure smooth transactions, the task could seem formidable without the right tools and guidance. That’s where ACH Genie comes into play. We provide a bespoke advanced ACH validation tool that offers swift and accurate ACH file validation to ensure seamless transactions.

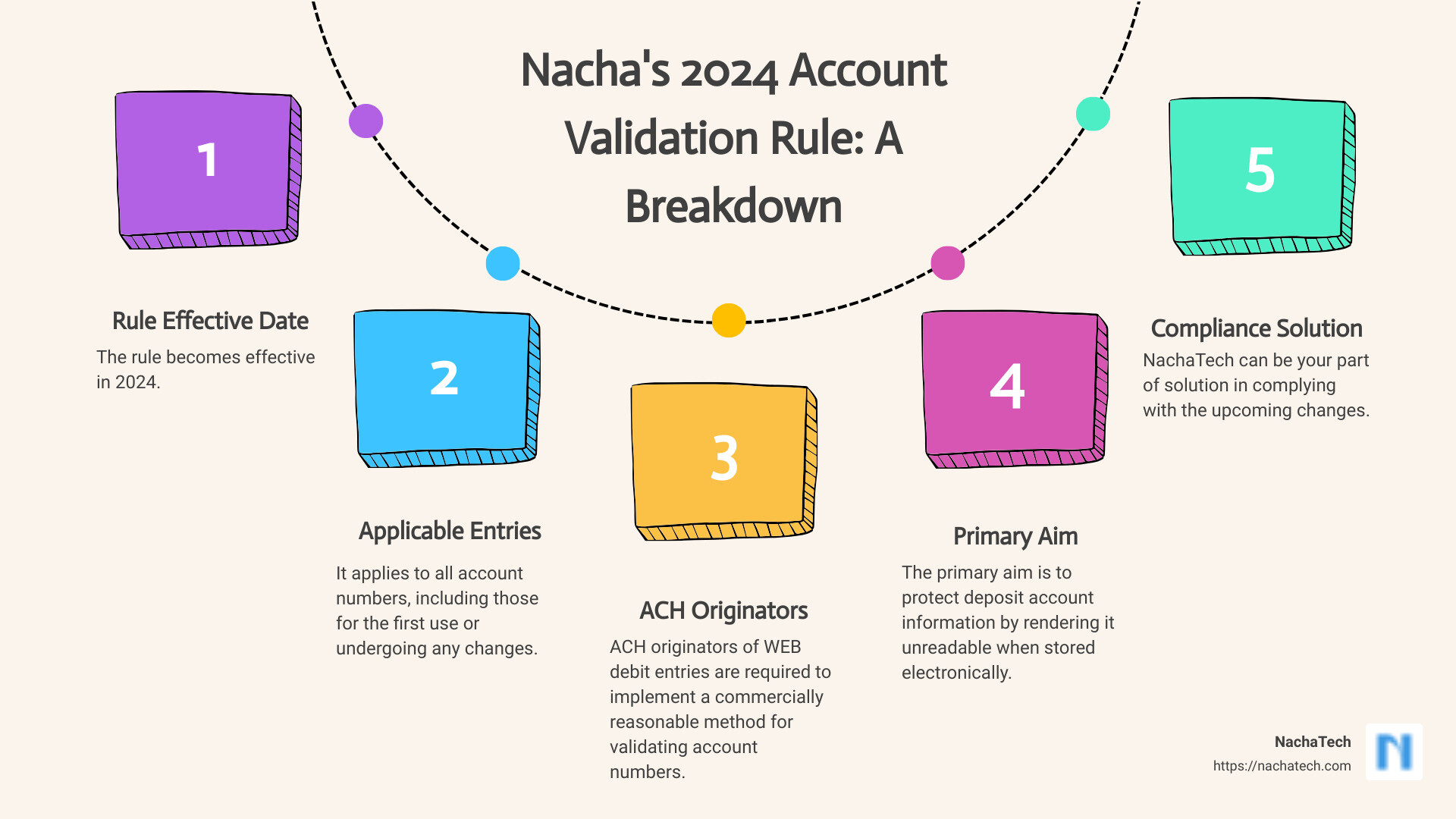

Here’s a quick summary of what the Nacha’s 2024 Account Validation Rule entails:

- It requires ACH originators of WEB debit entries to implement a commercially reasonable method for validating account numbers.

- The rule becomes effective in 2024.

- It applies to all account numbers, including those for the first use or undergoing any changes.

- The primary aim is to protect deposit account information by rendering it unreadable when stored electronically.

In the sections that follow, we will take a closer look at Nacha’s 2024 Account Validation rule, its implications, different methods for validation, and ultimately, how ACH Genie can be your part of solution in complying with the upcoming changes.

Understanding the WEB Debit Account Validation Rule

In the ever-evolving landscape of digital transactions, Nacha’s 2024 Account Validation rule stands as a critical milestone. This rule, which was announced following the implementation of the WEB Debit Account Validation Rule, aims to further fortify the security of ACH (Automated Clearing House) transactions.

Simply put, the WEB Debit Account Validation Rule requires ACH originators of WEB debit entries to implement a commercially reasonable method to verify that the account number to be used for a WEB debit entry is for a valid account. The essence of this rule is to ensure that the first use of an account number, or any subsequent changes to it, are validated before the transaction is processed.

The rule is not prescriptive about the method to be used for validation. However, it emphasizes that the chosen method should be effective and reasonable for detecting and preventing fraudulent transactions. The rule also clarifies that “validation” is required as part of every commercially reasonable fraud detection system. This is a significant shift from the previous practice where validating first-use consumer account information for ACH payments was optional.

The rule changes are set to become effective in 2024, giving businesses, financial institutions, and Third-Party Service Providers (TPSPs) and Third-Party Senders (TPSs) ample time to adjust their systems and processes to comply with the new requirement.

As we delve deeper into the need for account validation and the different methods for achieving it, it is important to understand that ACH Genie’s ACH validation tool can play a pivotal role in ensuring seamless compliance with the upcoming changes.

In the next section, we will explore the importance of account validation in the payments ecosystem and how ACH Genie’s solution can help streamline this process. Remember, our goal is to ensure your financial transactions are secure, efficient, and in compliance with Nacha’s evolving regulations. For comprehensive insights into Nacha’s rules and regulations, you can always refer to our guide on Mastering NACHA Compliance: Your Ultimate Guide.

The Importance of Account Validation in the Payments Ecosystem

In an increasingly digital world, conducting secure and efficient financial transactions is paramount. With the implementation of Nacha’s 2024 Account Validation Rule, the payments ecosystem is adjusting to new account validation realities and opportunities. As an institution involved in Automated Clearing House (ACH) transactions, understanding the importance of account validation and how it impacts your operations is crucial.

The core idea behind Nacha’s account validation rules is to ensure that ACH transactions are secure and reduce the risk of fraudulent activities. Account validation serves as a verification step to confirm that an account is open and capable of accepting ACH entries. This prevents unauthorized transactions, reduces the risk of fraud, and contributes to maintaining the integrity of the payments ecosystem.

However, it’s important to note that Nacha’s rules do not impose a specific method for validating account information. The rules are neutral with regard to the choice of specific methods or technologies. Whether you choose to use a Prenotification Entry, ACH micro-transaction verification, or a commercially available validation service, the choice is yours. The key is to select a method that aligns with your business model, risk profile, and is considered commercially reasonable.

The question of commercial reasonableness is crucial here. What your institution might consider reasonable will depend on your particular situation and how it compares to similarly-situated Originators. This is why you need to consult with your legal counsel, risk department, or other advisors to determine which account validation method meets the commercially reasonable standard for your institution.

What’s more, if you’re an Originator who has a proven history of successful payments with an account, Nacha rules consider this as a sufficient means for validation for the use of the account with a new WEB authorization. This rule applies on a going-forward basis and does not apply retroactively to account numbers that have already been used for WEB debits.

At ACH Genie, we understand that these rules and requirements might seem complex. That’s why we’re committed to helping you navigate through them, providing you with the tools and solutions you need to comply with Nacha’s regulations. From fast validation of ABA numbers to advanced features that help prevent ACH payment rejections, our solutions are designed to streamline your ACH transactions and ensure their accuracy and validity.

In the next section, we’ll discuss how ACH Genie can help you comply with Nacha’s Account Validation Rule. In the meantime, for a more comprehensive understanding of Nacha’s regulations, consider checking out our guide on Nacha Account Validation: Streamlining Account Verification Process.

How ACH Genie Can Help You Comply with Nacha’s Account Validation Rule

Stepping up to the challenges posed by the new Nacha 2024 account validation rule, we at ACH Genie provide an innovative solution to sail you smoothly through the stormy seas of ACH transactions. Our state-of-the-art ACH Validation Tool, designed meticulously with the needs of financial institutions like yours in mind, is here to ensure your ACH transactions are efficient, error-free, and compliant with the Nacha’s new requirements.

Fast and Powerful Validation with ACH Genie

As we all know, in the financial world, time is money. This is why our validation tool operates at lightning speed, validating large ACH files with thousands of transactions in mere seconds. Efficiency and accuracy are at the core of our software, ensuring your operations run smoothly and your transactions are validated swiftly.

Raw Line Editing and ABA Validation

Errors happen, but with ACH Genie, they don’t have to slow you down. Our software provides raw line editing, allowing you to open files with major errors and correct them without needing to switch to a text editor like Notepad. This not only saves you time but also provides a more streamlined editing experience. Additionally, ACH Genie performs fast validation of ABA numbers using an embedded ABA database that can be updated from FedACH on-demand, ensuring all your ABA numbers are accurate and up-to-date.

Seamless Integration with Your Existing Systems

We understand that with the introduction of new rules, some originators may need to re-tool their existing fraud detection system. Our solution seamlessly integrates with your existing systems, saving you the hassle of overhauling your entire setup. This way, you can focus on what matters most – delivering excellent service to your customers.

Secure and Compliant Transactions

Furthermore, we take data security very seriously. As such, our tool incorporates stringent security protocols to protect sensitive data. This way, you can rest assured that while your ACH transactions are processed swiftly, they are also secure.

Preferred Partner of Nacha

We are proud to be a Preferred Partner of Nacha, trusted for securing electronic messaging and payments. This recognition testifies to the effectiveness of our Account Verification tool in meeting the new Nacha regulations. By using our tool, you can boost consumer satisfaction, enable new back-office efficiencies, and most importantly, stay compliant with Nacha’s new rule.

In conclusion, complying with Nacha’s Account Validation Rule doesn’t have to be a daunting task. With ACH Genie’s powerful ACH Validation Tool, you can stay ahead of the curve, ensuring your transactions are compliant and secure. For more information on how our tool can help streamline your transactions, consider checking out our Nacha File Validator guide.

Different Methods for Validating Account Information

In the bustling world of financial transactions, accuracy is paramount. The Nacha 2024 account validation rule reinforces the importance of ensuring that all account information is validated before initiating web debits. To help you navigate this rule, let’s explore the different methods of account validation.

ACH Prenotification

ACH Prenotification is a tried-and-true method of account validation. It’s a non-monetary ACH entry sent to the receiving bank to verify the accuracy of the routing number and account number. This process can help confirm if the account is open and can accept ACH entries prior to initiating a transaction. However, it’s crucial to note that this method doesn’t verify account ownership, which might be necessary based on your business model and risk profile.

ACH Micro-Transaction Verification

Another method to validate account information is through ACH micro-transaction verification. This process involves sending a small transaction (usually less than a dollar) to the recipient’s account. Once the transaction is successful, the recipient confirms the transaction amount, thereby verifying that the account is active, reachable, and the account information is correct. However, this method can be time-consuming due to the waiting period for the micro-transaction to settle.

Commercially Available Validation Services

Commercially available validation services provide a more modern solution to account validation. These services use advanced technologies to verify account information in real-time or near real-time, making the validation process faster and more efficient. Moreover, these services can provide additional layers of fraud detection and risk mitigation.

At ACH Genie, we offer a powerful ACH validation tool that not only validates ABA numbers but also provides advanced editing features to ensure compliance with NACHA standards. Our tool can open and edit ACH files with major errors, a feature that most other tools lack, making it an ideal solution for businesses that deal with large volumes of ACH transactions.

Remember, the choice of account validation method should be based on your specific needs and business model. While the Nacha Operating Rules do not enforce a specific validation method, they stress the importance of a “commercially reasonable” approach to account validation. For more information, check out our guide on Nacha compliance.

In the next section, we’ll discuss the role of third-party senders in account validation and how they can assist in complying with the Nacha 2024 account validation rule. Stay tuned!

The Role of Third-Party Senders in Account Validation

In the ever-evolving landscape of financial transactions, third-party senders hold a pivotal role in the ACH Network. They are key players in the account validation process, acting as intermediaries between the originator (the entity that initiates the ACH entry) and the receiver’s financial institution.

As we prepare for the implementation of the Nacha 2024 account validation rule, it’s crucial for financial institutions like ours to understand how third-party senders can help us comply with the new standards.

Third-Party Senders: Enhancing Validation Accuracy

Third-party senders have access to extensive data pools and advanced technologies that can validate account information with high accuracy. Their services can be particularly useful when dealing with WEB debit entries, the focus of the Nacha 2024 account validation rule.

These third-party vendors may use various methods to validate account information, such as validation of online banking credentials or data consortium. Some may also offer ACH Prenotification Entries or micro-transaction processing as an alternative validation method in some cases.

At ACH Genie, we have a list of reliable third-party validation service vendors that we can recommend depending on your specific needs. These include data consortium vendors like Accelitas, Early Warning, and Microbilt, among others.

Meeting Nacha’s Standards with the Help of Third-Party Senders

As we’ve mentioned in our comprehensive guide to efficient financial transactions, ensuring compliance with Nacha’s regulations is paramount to smooth ACH transactions. With the new Nacha 2024 account validation rule, partnering with third-party senders can be a strategic move to meet the new standards.

Remember, the new rule requires a commercially reasonable method to verify that the account number to be used for a WEB debit entry is for a valid account. Third-party senders, with their technological capabilities and extensive data pools, can provide these commercially reasonable account validation methods.

Streamlining Transactions with Third-Party Senders

In conclusion, third-party senders play a significant role in account validation, particularly in light of the upcoming Nacha 2024 account validation rule. By enabling accurate account validation, they can help businesses and financial institutions like ours streamline ACH transactions and ensure compliance with Nacha’s regulations.

With the right third-party sender, you can enhance the efficiency of your ACH transactions and boost your operational efficiency. For more insights on how to optimize your ACH transactions and comply with Nacha’s rules, check out our detailed guide on mastering Nacha compliance.

How the New Rule Enhances Data Security

As we move towards an increasingly digital world, the security of financial data becomes even more critical. The new Nacha account validation rule, slated to be effective by 2024, is a significant leap towards enhancing data security in the payments ecosystem.

This new rule supplements the previous ACH Security Framework data protection requirements by explicitly requiring large, non-financial institution Originators, Third-Party Service Providers (TPSPs), and Third-Party Senders (TPSs) to protect deposit account information. This means that when they store deposit account information electronically, it must be rendered unreadable, thereby reducing the risk of unauthorized access and potential fraud.

With more and more financial transactions taking place online, the security of sensitive data has become a paramount concern. The risk of data breaches and cyber-attacks is ever-present, and the financial repercussions of such incidents can be devastating. The account validation rule aims to mitigate these risks by ensuring that account numbers are validated before they are used for WEB debit entries.

At ACH Genie, we understand the importance of data security. That’s why we leverage advanced technology to ensure that your ACH transactions are not only swift but also secure. Our ABA number validation tool incorporates stringent security protocols to protect users’ data. Plus, we keep our tool up-to-date with the latest financial regulations and technology advancements, which forms part of our commitment to offer enhanced performance and ensure your ACH files are processed efficiently and error-free.

In essence, the new Nacha rule enhances data security by validating account information and ensuring that stored data is made unreadable. This not only protects the customers’ sensitive information but also contributes to the overall integrity and reliability of the ACH network.

For more information on how we can help you comply with this new rule, check out our page on Streamlining Transactions with a Nacha File Validator.

The Impact of the Rule on Same Day ACH Transactions

As we move forward in the fast-paced digital age, the significance of efficient and secure transactions cannot be overstated. This is where the new Nacha 2024 Account Validation Rule comes into play. Not only does it contribute to the overall integrity of the ACH network, but it also enhances the performance of Same Day ACH transactions.

Same Day ACH is a powerful service that allows quicker crediting and debiting of ACH transactions within the same day. However, for this service to function optimally, the accuracy of account information is paramount. This is where Nacha’s Account Validation Rule shines, ensuring the accuracy of account numbers used for WEB debit entries.

The implementation of this rule in the Same Day ACH service will reduce the chances of transaction rejections due to incorrect account information. This is a major advantage for financial institutions that rely on the speed and efficiency of Same Day ACH. The rule will increase the reliability of these transactions, thereby improving the overall user experience.

On top of that, the rule also bolsters the security of Same Day ACH transactions. By requiring that account numbers are validated before use, the rule minimizes the risk of fraudulent transactions. Furthermore, it supports the ACH Security Framework’s data protection requirements, ensuring that deposit account information is rendered unreadable when stored electronically.

At ACH Genie, we understand the importance of staying on top of these changes and regulations. Our ACH File Validator tool is designed to help financial institutions like yours comply with this new rule. It offers a fast and efficient way to validate ABA numbers, promoting the smooth operation of your Same Day ACH transactions.

In conclusion, the new Nacha rule not only fortifies the security of ACH transactions but also significantly enhances the efficiency of Same Day ACH services. By ensuring the accuracy of account information, the rule reduces transaction rejections, thereby saving time and resources for financial institutions. Stay ahead of the curve by embracing these changes and optimizing your ACH transactions with our user-friendly tools and solutions at ACH Genie.

Next, we’ll delve into how our Nacha File Validator helps streamline your transactions and ensure compliance with Nacha’s Account Validation Rule. Stay tuned!

Conclusion: Streamlining Transactions with Nacha File Validator

As we navigate the evolving landscape of digital transactions, the need to ensure operational efficiency, minimize fraud, and promote data security becomes paramount. The new Nacha 2024 account validation rule is a significant step towards achieving these objectives. However, it also brings new challenges, especially for financial institutions grappling with ACH payment rejections and errors in their NACHA files. That’s where we, at ACH Genie, come in with our innovative solutions.

Our ACH File Validator is an advanced tool designed to help your institution comply with Nacha’s account validation requirements. It performs comprehensive file validation, checks for proper ordering of elements, and ensures field-specific validation. By leveraging our validator, you can significantly streamline your transactions, save time, and reduce the potential for errors.

Our validator also features a fast ABA validation process, thanks to an internal embedded database that eliminates network latency and alleviates security concerns. Furthermore, it updates all vital values to make sure they comply with the NACHA standards, and provides an easy-to-use rebalance function to update all the values.

But our support doesn’t stop there. We’re committed to helping you navigate the evolving financial landscape. As part of our comprehensive guide to efficient financial transactions, we offer insights into the roles of third-party senders, the importance of data security, and how the new rule enhances the speed and efficiency of same-day ACH transactions.

Whether you’re looking to understand the meaning and importance of Nacha or to master Nacha compliance, our expert team and resources are at your disposal. We’re dedicated to helping you succeed in this fast-paced, digital world of financial transactions.

In conclusion, the future of ACH and NACHA files looks promising, with advancements geared towards increasing efficiency, reducing fraud, and improving transaction speed. By understanding these changes and leveraging tools like ACH Genie, businesses can position themselves for success in the evolving landscape of financial transactions.

Remember, as the digital landscape continues to evolve, so do we. At ACH Genie, we’re always on the forefront, ready to help you navigate the ever-changing world of financial transactions. We invite you to take advantage of our solutions and expertise to streamline your transactions and ensure compliance with Nacha’s 2024 account validation rule.