Categories: NACHA File Validation

Are you a financial institution grappling with consistent ACH payment rejections? Are you tired of scouring through lines of code in search of errors in your NACHA files? For organizations vested in the financial world, virtually nothing derails smooth operations like inconsistent transactions. The culprit is often incorrectly formatted NACHA files, specifically those utilizing the NACHA payment format CTX.

The Corporate Trade Exchange (CTX) format, an integral part of the NACHA files, forms the backbone of various electronic financial transactions today. Flawlessly handling batches of transactions, from direct deposits to B2B payments, hinges on mastering this universally accepted format. Before delving into the nitty-gritty of how this format enhances your transactions, let’s first cover the basics.

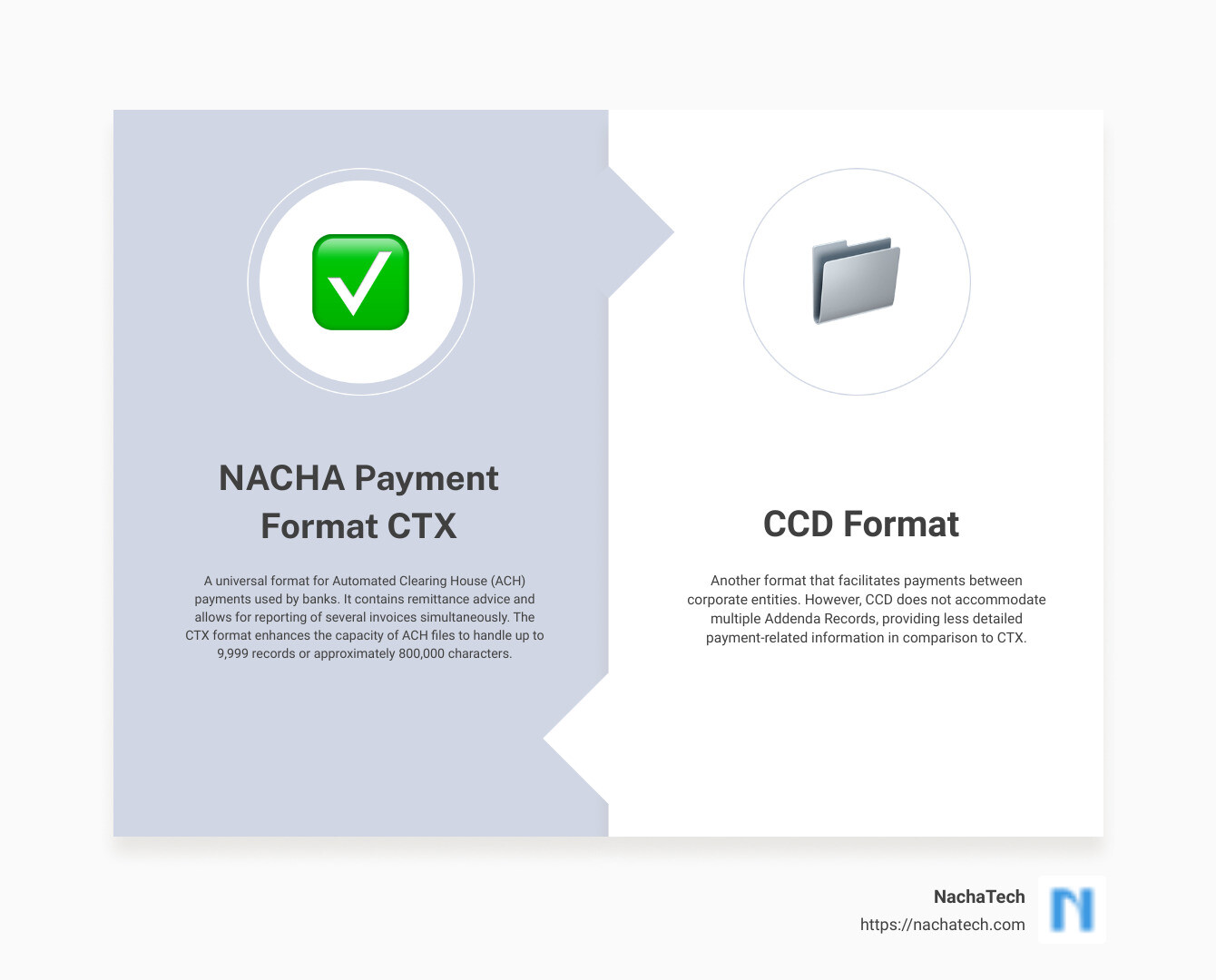

- NACHA Payment Format CTX: A universal format for Automated Clearing House (ACH) payments used by banks. It contains remittance advice and allows for reporting of several invoices simultaneously. The CTX format enhances the capacity of ACH files to handle up to 9,999 records or approximately 800,000 characters.

- Differentiating CTX from CCD Format: Both these formats facilitate payments between corporate entities. However, CTX offers the added benefit of accommodating multiple Addenda Records. Such records supply the receiving company with detailed payment-related information like invoice data.

- Benefits: Utilizing the CTX format promotes uniformity, boosts security, and enhances efficiency in processing financial exchanges, directly supporting smooth business operations.

An error in these files is more than a mere inconvenience—it disrupts your cash flow and strains business relationships. However, solutions like ACH Genie draw the line on these frustrations by enabling you to edit and validate ACH files with major errors. As the financial world gravitates towards digital transactions, understanding the CTX format within NACHA files becomes an indispensable asset for financial institutions like yours. Let’s explore this journey together.

Understanding the Basics of ACH Payments

Automated Clearing House (ACH) payments form the backbone of countless transactions today, from business-to-business payments to direct deposits. They are a type of electronic funds transfer that offers a secure, efficient method for receiving and sending payments through the ACH network. This network is a batch-oriented processing and delivery system that facilitates the distribution and settlement of electronic transactions and payments among financial institutions.

The Role of ACH in Electronic Funds Transfer

ACH payments play a pivotal role in electronic funds transfer. They eliminate the need for paper checks, reducing payment issues due to lost, stolen, or misdirected checks. Furthermore, they eradicate mail delays and provide greater payment certainty for cash planning. The opportunity to electronically update and streamline your cash application and receivables operations is an added advantage .

With ACH Genie, we take the complexity out of ACH file formatting, providing you with the tools to manage your ACH files effectively. This helps you navigate the intricate world of financial transactions with ease and accuracy.

Benefits of ACH Payments for Vendors

For vendors, ACH payments bring several benefits. They offer an efficient method of receiving payments, eliminating the handling of paper checks. They also reduce payment problems due to lost, stolen, or misdirected checks. Moreover, they eliminate mail delays, providing vendors with more predictable payment timelines. This, in turn, allows for better cash flow planning.

In addition to these, ACH payments also provide an opportunity to electronically update and streamline cash application and receivables operations. This can lead to improved operational efficiency and cost savings.

At ACH Genie, we understand the importance of these benefits. That’s why we’ve designed our Nacha File Validator to help you avoid common reasons for ACH payment rejections such as incorrect bank account information, insufficient funds, closed or frozen accounts, invalid ABA numbers, and errors in NACHA file formatting .

By simplifying the process of ACH file management, ACH Genie empowers you to leverage the benefits of ACH payments to the fullest. Next, let’s dive deeper into the role of NACHA format in ACH payments.

The Importance of NACHA Format in ACH Payments

In the intricate world of financial transactions, the NACHA format serves as an indispensable tool. It forms the backbone of countless transactions, from B2B payments to direct deposits, and is integral to the smooth operation of businesses today. This format, with its fixed-width ASCII file, specific record sequence, and standardized codes, promotes uniformity, security, and efficiency in monetary exchanges.

Overview of NACHA Format Options: CCD and CTX

There are two primary NACHA format options that businesses can utilize for ACH payments: CCD (Cash Concentration or Disbursement) and CTX (Corporate Trade Exchange).

The CCD format is typically used for business-to-business transactions. It is streamlined and simple, allowing for the easy transfer of funds between corporate entities.

The CTX format, on the other hand, is a more advanced and versatile option. It is particularly useful when you want to include more than one addenda record, which is used to supply payment-related information to the receiving company .

The Distinction Between CCD and CTX Format

While both CCD and CTX are designed for making or collecting payments to or from other corporate entities, the key difference lies in the level of detail they can provide.

The CCD format is simpler and includes just one addenda record. This makes it the go-to choice for businesses that need to make straightforward payments without additional data or remittance information.

CTX, in contrast, can incorporate multiple addenda records, providing detailed remittance information such as invoice numbering. This makes it the preferred choice for businesses that need to include extensive payment-related information with their transactions.

In fact, the CTX format offers companies nearly 10,000 lines of data that can handle roughly 800,000 characters altogether. This level of detail is invaluable for businesses that need to manage complex transactions with multiple invoices .

At ACH Genie, we understand the importance of choosing the right format for your ACH transactions. Our tools are designed to help you navigate the complexities of ACH file formatting, minimize errors, and streamline your financial transactions. Whether you choose CCD or CTX, we have the tools and expertise to ensure your transactions are processed smoothly and efficiently.

Deep Dive into CTX Format

Now that we’ve discussed the basics of ACH payments and the importance of NACHA formats, let’s take a closer look at the CTX format. CTX, or Corporate Trade Exchange, is a universally recognized format for ACH payments used by banks and other financial institutions to provide comprehensive remittance advice.

The Role of CTX in Corporate Trade Exchange

In Corporate Trade Exchange, CTX plays a crucial role by enabling businesses to include multiple addenda records with their ACH payments. This is particularly useful when there’s a need to include detailed payment-related information, like invoice details, to the receiving company. In short, CTX is the preferred format when you need to deliver more than just the payment.

Understanding EDI CTX Format and Its Capacity

When we talk about CTX, it’s worth mentioning the EDI (Electronic Data Interchange) 820 format. The EDI 820 format allows remittance for several invoices simultaneously, making it an ideal choice for businesses that handle large volumes of transactions. The CTX format offers an impressive capacity, with nearly 10,000 lines of data that can handle roughly 800,000 characters altogether. This data-rich format allows for more detailed and comprehensive remittance advice, thus improving the clarity and efficiency of B2B payments.

The Significance of CTX Code in ACH Payments

The CTX code in ACH payments is a Standard Entry Class code that hosts multiple addenda records. These records provide valuable additional information on each transaction, also known as remittance information. This can include details like invoice numbering, making it easier for businesses to track and reconcile their transactions. The CTX code is a vital component of the ACH payment process, ensuring that all necessary information accompanies the payment.

At ACH Genie, we understand the nuances of ACH payments and the significance of choosing the right file format. Our tools are designed to simplify and streamline the process, whether you’re working with CCD or CTX format. With the ability to handle major errors, raw line editing, and fast validation of ABA numbers, we make handling ACH files a breeze.

In the next section, we’ll look at how ACH Genie can help you streamline your ACH transactions, ensuring smooth and efficient financial operations.

How ACH Genie Streamlines ACH Transactions

Navigating ACH payments can be a complex journey. But at ACH Genie, we’ve developed a robust solution that simplifies this process and ensures a seamless financial experience.

The Functionality of ACH Genie in Editing and Validating NACHA Files

Our primary function lies in editing and validating NACHA files. As a financial institution, you are likely to encounter ACH payment rejections and errors in your NACHA files. These can be a major roadblock, causing delays in transactions and resulting in unnecessary costs.

But with ACH Genie, you can open and edit ACH files with major errors. This functionality enables you to identify and correct errors with ease, thus preventing potential ACH payment rejections.

In addition to this, we offer raw line editing, a feature that allows you to make necessary changes beyond the usual constraints, while still adhering to NACHA standards. This flexibility empowers you to have full control over your ACH transactions.

The Unique Selling Point of ACH Genie: Handling Major Errors and Fast Validation

What sets us apart is our ability to handle major errors and offer rapid validation of ABA (American Bankers Association) numbers.

As highlighted on Reddit, incorrect ABA numbers can lead to failed transactions and consequent ACH payment rejections. With our embedded ABA database, we facilitate swift validation of ABA numbers, ensuring your ACH files contain valid ABA numbers. This significantly reduces the chances of ACH payment rejections, ensuring a smoother transaction process.

Our ability to handle major errors and provide raw line editing, coupled with fast ABA number validation, makes us an invaluable ally in ACH file management. At ACH Genie, we are not just a tool – we are a lifeline for businesses seeking to streamline their ACH processing and ensure successful transactions.

Our solution helps you steer clear of the pitfalls of ACH payment rejections, allowing you to focus on what matters most – providing excellent service to your customers.

Next, let’s explore some practical applications of CTX format. We’ll examine how it is used in child support payments, and the process of converting these payments to EFT/EDI CCD+ or CTX format.

Practical Applications of CTX Format

While the nacha payment format ctx is used widely in the business world for large-scale financial transactions, its applications extend beyond the boundaries of corporate finance. In fact, one of the most significant uses of the CTX format is in the realm of child support payments.

Use of CTX Format in Child Support Payments

In the context of child support payments, the CTX format has emerged as a reliable solution for managing complex financial exchanges. This format, due to its capacity to handle a significant number of addenda records, can transmit complete remittance information with a single payment.

This is particularly beneficial for child support payments, where one CTX payment can cover multiple invoices. The full remittance information is transmitted to the vendor’s financial institution, ensuring a swift and efficient payment process.

In addition, the use of CTX format reduces the chance of error, saves administrative processing costs, and is faster than traditional methods like mailing paper checks.

The Process of Converting Child Support Payments to EFT/EDI CCD+ or CTX Format

The Electronic Funds Transfer (EFT) is a process that electronically transfers funds from one bank to another. In child support applications, EFTs are used to transfer child support payments and remittance information simultaneously to the State child support agencies.

The process of converting these payments to the EFT/EDI CCD+ or CTX format is targeted towards child support orders enforced by a State child support enforcement agency and income withholdings for all child support orders initially issued on or after January 1, 1994.

This conversion process is facilitated by the Welfare Reform legislation, which developed centralized collection capability for all old and new orders under the legislation, as well as other types of Child Support Payments (CSP). Both ACH corporate formats, CCD+ and CTX, can be accepted by centralized States, providing a streamlined and efficient process.

At ACH Genie, we recognize the importance of these transactions and strive to provide solutions that make the process as seamless as possible. Our tools are designed to help manage ACH files effectively, reducing errors and ensuring smooth financial transactions.

In the next section, we will highlight the value of the CTX format in streamlining transactions, reinforcing why understanding and mastering the nacha payment format ctx is a game-changer in the financial landscape.

Conclusion: The Value of CTX Format in Streamlining Transactions

The Corporate Trade Exchange (CTX) format is a powerful tool in the ACH payments landscape. As we have seen throughout this guide, it provides businesses with the ability to handle large volumes of data, accommodating up to 10,000 lines and 800,000 characters at once. This makes it an excellent choice for businesses that need to remit multiple invoices simultaneously, especially when dealing with other corporate entities.

The nacha payment format ctx offers a level of detail and flexibility that is unparalleled, providing businesses with the ability to include extensive remittance information through its multiple addenda records. This eliminates the need for separate remittance advice and improves the efficiency of B2B transactions. And, with the CTX format, businesses can include invoice information directly in the payment file, making reconciliation easier and faster.

The challenges of managing ACH files can be significant, particularly when considering the sensitivity of the information they contain and the potential for errors and inaccuracies. However, with the right tools and understanding, businesses can harness the power of the CTX format to streamline their transactions. This is where we, at ACH Genie, come in. Our solutions provide the ability to edit and validate ACH files with major errors, offering features like raw line editing and fast validation of ABA numbers.

At ACH Genie, we understand that mastering the ACH file format is not a luxury but a necessity in today’s digital age. We believe that the key to successful financial transactions lies not just in the transactions themselves, but in the mastery of the tools and systems that facilitate them. And that’s why understanding the CTX format is so crucial.

In conclusion, the CTX format is a game-changing tool in financial transactions. By embracing the CTX format, understanding its structure, and utilizing the right tools to manage it, businesses can ensure smooth transactions and drive their financial success.

For those interested in further exploring the ACH payment landscape and how ACH Genie can streamline your financial transactions, we invite you to visit our Nacha File Format section and discover more about our ACH Validation Tool. Our goal is to provide you with the tools and knowledge necessary to navigate the complexities of ACH payments and the CTX format.

Embrace the power of the CTX format and let ACH Genie be your guide to financial transaction success.