Categories: NACHA file validator

Introduction to Nacha Payments and Nacha Files

In the ever-evolving landscape of financial transactions, the role of Automated Clearing House (ACH) payments and National Automated Clearing House Association (NACHA) files is becoming increasingly significant. As a financial institution, you might be familiar with these terms, but understanding them in depth is crucial for efficient money transfers. This article aims to shed light on the significance of Nacha payments and Nacha files, and how you can streamline your transactions using a Nacha file validator.

Nacha payments, a popular type of US electronic bank transfer, are used for various transactions, including consumer purchases, bill payments, employee paychecks, and tax payments. The versatility of ACH payments has led to the ACH network processing 26.8 billion payments that totaled almost $62 trillion in 2020 alone.

Yet, the process is not devoid of challenges. Financial institutions often struggle with ACH payment rejections and errors in their NACHA files. This is where a Nacha file validator comes into play.

A Nacha file is a document that contains all the necessary information and transfer instructions related to a requested ACH transaction. It is governed by Nacha’s precise operating rules, ensuring the safe and secure transfer of funds between different banks across the US.

However, compiling these files manually is prone to human error, which could lead to payment rejections. To avoid this, most banking institutions automate the process of compiling these documents using a Nacha file validator, such as ACH Genie.

In the sections to follow, we will delve deeper into the role of Nacha in the ACH network, the importance of Nacha compliance in ACH payments, and how a Nacha file validator can help streamline your financial transactions.

Understanding the Role of Nacha in the ACH Network

Just like a symphony conductor ensures harmony among the orchestra’s instruments, Nacha orchestrates the smooth operation of the ACH network. Standing tall as an independent organization, Nacha, formerly known as the National Automated Clearing House Association, is the steward of the electronic system that links all U.S. bank accounts. It enables the seamless movement of money among them—a whopping $73 trillion in 2021 alone.

But Nacha is not just about big numbers. It’s about efficiently enabling billions of electronic financial transactions, such as direct deposits, Social Security and government benefits statements, electronic bill payments, person-to-person (P2P), and business-to-business (B2B) payments.

As the backbone of the U.S. financial system, Nacha takes on a multifaceted role. It establishes the rules and standards for money transfer between accounts held at different financial or payments companies. By providing a common framework, Nacha eliminates confusion and ensures that all financial institutions are singing from the same hymn sheet.

A key milestone in Nacha’s journey was its merger with the Interactive Financial eXchange (IFX) Forum in 2018. This union enhanced the capabilities of Nacha, providing it with additional resources to develop and implement specifications for financial data systems.

Nacha’s focus doesn’t stop at maintaining the status quo. It is also committed to future-proofing the ACH network. Through its supervisory and rule-making functions, Nacha strives to update technologies and implement new payment systems, ensuring the ACH network continues to meet the evolving needs of businesses and consumers.

In summary, Nacha is the maestro of the ACH network, ensuring that every transaction hits the right note. Its role is crucial in maintaining a secure, efficient, and reliable payment system for all U.S. financial institutions. As we move forward, understanding the workings of Nacha and the ACH network becomes paramount, especially for financial institutions looking to streamline their transactions and reduce payment rejections.

The Importance of Nacha Compliance in ACH Payments

Stepping into the world of ACH payments without an understanding of Nacha compliance is like diving into an ocean without a life jacket. Nacha compliance is the lifeblood of the ACH network, ensuring that all electronic financial transactions adhere to a standardized set of rules and guidelines.

The Essence of Nacha Compliance

Nacha, the National Automated Clearing House Association, is an independent organization that operates the ACH network. It’s like a conductor orchestrating a symphony of transactions between banks, credit unions, and payment processing companies. Nacha compliance is essentially abiding by the rules of this conductor, thereby ensuring a harmonious financial ensemble.

Nacha’s rules and responsibilities are extensive. They include translating federal legislation and executive rules impacting ACH payments into clear instructions for financial institutions, businesses, and individuals participating in the ACH network. Moreover, Nacha is responsible for enforcing these rules and managing the evolution of the ACH network to meet the ever-changing needs of the payments world.

Why Nacha Compliance Matters

In 2020, the ACH network processed 26.8 billion payments, totaling nearly $62 trillion. These numbers underline the sheer volume and value of transactions flowing through the ACH network and the crucial role of Nacha in managing this colossal traffic.

Nacha compliance is vital for two main reasons. Firstly, it ensures the smooth flow of transactions, minimizing errors and rejections that can disrupt business operations and strain relationships with clients. Secondly, compliance with Nacha rules safeguards the integrity of the ACH network, protecting it from fraudulent activities and maintaining the trust and confidence of its users.

Navigating Nacha Compliance

Navigating Nacha compliance can be a daunting task, given the intricate nature of the ACH network and the complexity of the rules governing it. However, understanding and adhering to Nacha compliance is not an option but a necessity for financial institutions. Non-compliance can result in penalties, transaction rejections, and loss of access to the ACH network.

To streamline compliance, financial institutions need a robust solution like ACH Genie that provides tools for editing and validating ACH files. By identifying and rectifying major errors, validating ABA numbers, and providing raw line editing, ACH Genie simplifies the complex task of Nacha compliance.

In conclusion, Nacha compliance is a crucial component of ACH payments. Understanding its importance and mastering the tools that facilitate compliance can help financial institutions streamline their transactions, reduce payment rejections, and pave the way for financial success. The next section will delve deeper into the workings of ACH payments, offering a closer look at the journey from initiation to transfer.

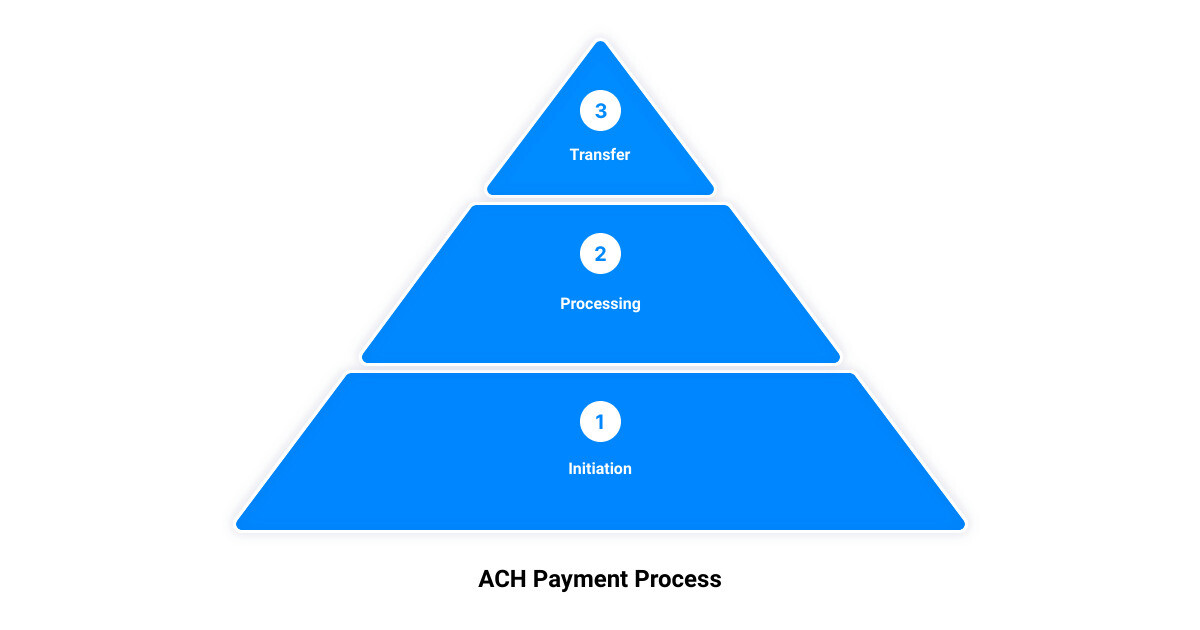

How ACH Payments Work: From Initiation to Transfer

If you’ve ever scratched your head wondering about the inner workings of ACH payments, here’s your chance to get enlightened. ACH payments, managed and governed by Nacha, are the bedrock of numerous financial transactions, including employee payments, customer bills, tax refunds, and commercial purchases. The process involved can seem arcane, but demystifying its mechanics can help you better manage your transactions and avoid potential hiccups.

The Journey of an ACH Payment

The journey of an ACH payment begins with the Originating Depository Financial Institution (ODFI), which is the bank that issues the ACH transfer request. On the other side of the spectrum is the Receiving Depository Financial Institution (RDFI), the bank that receives the ACH transfer request.

The ODFI kickstarts the process by sending a request to the RDFI to transfer funds from an account at the RDFI to an account at the ODFI. Interestingly, the flow of an ACH transfer can work in either direction, meaning the ODFI can either push funds to the RDFI or request funds to be sent from the RDFI. It’s worth noting that these terms don’t necessarily indicate which banking institution is sending or receiving the funds, but rather which one is initiating the transfer request.

The Role of an ACH Operator

The ODFI creates a file containing all the crucial information about the transfer request, including the transaction type (either credit or debit), routing numbers, account numbers, and the amount to be transferred. Within a set period, the ODFI gathers all ACH transfer requests into a batch and sends this batch of files to an ACH operator, which then dispatches the files to the RDFI.

Finalizing the Transfer

At this point, the bank where the funds are being withdrawn releases the funds, which then travel via the ACH network to the receiving account. This journey can take anywhere from several hours to a few days, depending on various factors.

By understanding this process, financial institutions can better navigate the intricacies of ACH payments, optimize their transaction processes, and reduce the likelihood of ACH payment rejections. However, this is just one piece of the puzzle. Our next section will delve deeper into the role of a Nacha file in ACH transactions and why these files are pivotal in ensuring a smooth flow of funds between banks.

The Role of a Nacha File in ACH Transactions

Riding the waves of the digital financial ecosystem requires a solid understanding of the role of Nacha files in ACH transactions. These files serve as the backbone of the entire Automated Clearing House (ACH) network, acting as the messenger carrying crucial banking instructions from one point to another.

At its core, a Nacha file is a text document that carries all the necessary information for an ACH transaction to occur. This includes the account numbers of the Originating Depository Financial Institution (ODFI) and the Receiving Depository Financial Institution (RDFI), the routing numbers for both these institutions, and a set of specific instructions for the transaction.

Each line of a Nacha file contains 94 characters, meticulously arranged in a predetermined order to maintain a standardized format. This structure allows the file to be easily read and processed by any bank or financial institution involved in the transaction. The file typically includes a file header and trailer, a batch header record with a service-class code, and an entry detail record.

The precision and specificity of a Nacha file format ensure that transactions are conducted without human error, enhancing the efficiency and accuracy of ACH payments. With billions of ACH transactions happening every year, the role of a Nacha file in ACH transactions is more critical than ever.

However, this reliance on Nacha files also presents a challenge. A single error in these files can result in transaction rejections, delays, and even financial loss. This is where the role of a Nacha file validator, such as ACH Genie, comes into play. In the next sections, we’ll explore the challenges of ACH payment rejections and how a Nacha file validator can help streamline your transactions, ensuring a smoother and more efficient ACH payment process.

The Challenges of ACH Payment Rejections and the Need for Nacha File Validation

Navigating the financial landscape is akin to crossing a minefield. One wrong move, and your business could be hit with ACH payment rejections that can disrupt your entire operation. With ACH payments becoming a central part of digital transactions, the stakes are higher than ever. No business can afford the delays, unnecessary costs, and strained relationships that often come with ACH payment rejections.

A Look at Common Causes of ACH Payment Rejections

The first step to mitigating the risk of ACH payment rejections is understanding their root causes. A few common culprits include incorrect bank account information, insufficient funds, closed or frozen accounts, and invalid ABA numbers. Incorrect bank account information can be the result of simple human error during the transaction process. Insufficient funds, on the other hand, are often the consequence of a lack of communication about payment schedules and amounts. Closed or frozen accounts and invalid ABA numbers can stem from outdated customer account information and incorrect bank details, respectively.

The Impact of ACH File Errors

Another key factor that often leads to ACH payment rejections is errors in the NACHA file format. NACHA files carry the instructions for the bank to process the transaction. If there’s an error in these instructions, the transaction can be disrupted, leading to a payment rejection.

The Need for a Nacha File Validator

Given the challenges of ACH payment rejections and the complexity of NACHA file format, it’s clear that businesses need a helping hand. This is where a Nacha file validator comes into the picture. A Nacha file validator can assist in editing and validating NACHA files before they are sent to the bank, significantly reducing the likelihood of payment rejections due to format errors.

Moreover, a Nacha file validator can help businesses tackle the common causes of ACH payment rejections head-on. For instance, it can facilitate the quick validation of ABA numbers, ensuring the correctness of entered bank details. It can also assist in identifying and rectifying major ACH file errors that can disrupt transactions.

In the next section, we’ll delve deeper into how ACH Genie, a state-of-the-art Nacha file validator, can help you streamline your transactions and overcome the challenges of ACH payment rejections. Stay tuned!

How ACH Genie Streamlines Transactions with Nacha File Validation

In the era of digital finance, the need for accurate and efficient transaction processing is paramount. Enter ACH Genie, a dynamic solution that combines advanced technology with user-friendly features to ensure seamless ACH transactions. As a powerful Nacha file validator, ACH Genie offers a robust suite of features designed to tackle common NACHA file errors, reducing ACH payment rejections, and streamlining your financial operations.

Opening and Editing ACH Files with Major Errors

The journey of error-free ACH transactions begins with opening and editing ACH files. But what happens when these files contain major errors? Most tools stumble at this hurdle, leading to a tedious manual editing process. ACH Genie, however, shines brightly in this aspect. It has the unique ability to open and validate ACH files with major errors, saving you time and effort. It’s easy-to-use interface guides you through the process of editing and rectifying files, turning a daunting task into a manageable one.

Providing Raw Line Editing for ACH Files

ACH Genie goes beyond standard editing features with its raw line editing capability. This feature allows for direct editing of the raw text of the file, a flexibility uncommon in conventional strong-typed editing systems. This means you can efficiently correct errors, ensuring your ACH files comply with the NACHA standard. No more struggling with complex and inflexible editing systems – with ACH Genie, you have the power to quickly and accurately fix errors directly in the file.

Fast Validation of ABA Numbers with ACH Genie

Another common pitfall in processing ACH transactions is an incorrect or invalid ABA number. With ACH Genie’s embedded ABA database, you can swiftly validate ABA numbers. This feature eliminates the potential delay caused by network latency and addresses security concerns related to external network traffic. By quickly checking the validity of ABA numbers, you can avoid one of the most common reasons for ACH payment rejections.

In summary, ACH Genie is a robust tool designed to streamline your ACH transactions. With its ability to open and edit files with major errors, raw line editing feature, and fast ABA number validation, ACH Genie sets itself apart as a reliable ally in ACH file validation. In the next section, we’ll explore the benefits of using ACH Genie for your Nacha file validation needs.

The Benefits of Using ACH Genie for Nacha File Validation

Efficiency and Power in One Package

Harness the power of efficiency with ACH Genie’s ACH validation tool. It has proven its mettle by processing large ACH files with thousands of transactions in under five seconds. A feat that takes competing products a whole minute to achieve. This level of efficiency frees up valuable resources, allowing your financial institution to focus on more strategic tasks.

Brace for Errors, No More Notepad

ACH Genie’s capabilities go beyond speed. It stands as a robust solution for opening and validating ACH files with major errors. Where other tools falter and force users to resort to Notepad for editing, ACH Genie thrives. It seamlessly opens the files, allowing users to correct the errors within the software itself. This feature eliminates the cumbersome process of manual editing, making error correction a breeze.

Stellar Customer Support

The benefits of using ACH Genie for Nacha file validation aren’t limited to its technical capabilities. It also shines in providing excellent customer support. Users have praised ACH Genie for its responsive service, a critical factor when dealing with complex financial transactions. You can rest assured knowing that help is just a call or email away.

Endorsements from Real Users

Don’t just take our word for it; listen to the testimonials from satisfied ACH Genie users. A representative from a state government’s Treasury Department lauded the software for its speed and ability to handle large files, stating, “Nice to have a product with great support. We like the speed and ability to handle large files.” A financial institution offering banking, credit, and lending solutions echoed the praise, noting the significant time savings when loading and validating large files.

In conclusion, ACH Genie is more than an advanced ACH validation tool. It’s a reliable partner that understands the needs of financial institutions and provides tailored solutions. By streamlining your transactions with ACH Genie, you’re not just adopting a tool; you’re embracing a future of seamless, efficient, and error-free ACH transactions.

Conclusion: Streamlining Your Transactions with ACH Genie

In today’s financial landscape, where digital transactions are the norm and efficiency is a must, the need for tools that can streamline ACH operations is undeniable. ACH Genie, with its robust features and proven track record, stands as a beacon of innovation in this domain.

As a Nacha file validator, ACH Genie offers more than just speed and accuracy. It’s a complete solution that addresses the real-world challenges faced by financial institutions in handling ACH transactions. From opening and editing ACH files with major errors to providing raw line editing and fast validation of ABA numbers, ACH Genie is equipped to handle it all.

User testimonials and real-world applications of ACH Genie further attest to its efficacy and value. Financial institutions have experienced significant time savings, error reduction, and improved workflow efficiency by integrating ACH Genie into their operations.

But beyond its technical capabilities, what sets ACH Genie apart is its understanding of the needs of financial institutions. It’s not just about providing a tool, but about being a reliable partner that can support your institution’s growth and success in the digital age.

By adopting ACH Genie, you’re not just choosing a tool; you’re choosing a future where ACH transactions are processed smoothly and swiftly, where payment rejections are a rarity rather than a frequent occurrence. You’re choosing a world where your resources are free to focus on strategic tasks, rather than being mired in the complexities of ACH file validation.

In conclusion, ACH Genie is more than just an advanced ACH validation tool. It’s a vital ally for financial institutions navigating the complex waters of ACH transactions. So streamline your transactions, reduce your errors, and embrace the future of ACH payments with ACH Genie. Your journey towards seamless, efficient, and error-free transactions starts here.